Site pages

Current course

Participants

General

Module 1 - Water availability and demand and Natio...

Module 2 - Irrigation projects and schemes of India

Module 3 - Concepts and definitions

Module 4 - Command Area Development and Water Mana...

Module 5 - On-Farm-Development works

Module 6 - Water Productivity

Module 7 - Tank & Tube well irrigation

Module 8 - Remote Sensing and GIS in Water Management

Module 9 - Participatory Irrigation Management

Module 10 - Water Pricing & Auditing

LESSON 8. FINANCIAL ASPECTS OF IRRIGATION PROJECTS IN INDIA

Introduction

A number of projects have been initiated for irrigation and related facilities in the country and are in operation to achieve these objectives involving huge investment. The water resources projects are largely developed executed and managed by the Government. The State Governments are primarily responsible for planning, implementation and management of the projects. However, the Central Water Commission, being the apex nodal agency in water resources sector, has the overall responsibility for its development, technical clearance and monitoring of the Major and Medium projects.

It is more important, from user point of view, for equitable distribution and optimal utilisation of irrigated water to the field of farmers. The Command Area Development Programme was initiated by constructing field channels, drainage system and land levelling of undulating land of farmers to meet the requirement. Removal of alkalinity and salinity of land are also carried out through Command Area Development Programme and is being funded by Central as well as State Government. Conjunctive use of ground and surface water also meet the requirement of equitable distribution of water for agriculture purpose. Minor Irrigation projects, by creating check dams and bunds, are other facets of conserving water and equitable distribution of water. All such activities are funded by Central and State Governments and parts of Minor Irrigation are in the domain of private ownership to facilitate irrigated water in ultimate use of agriculture.

8.1 Expenditures and receipts

The Capital Expenditure refers to the Finance Account that represents Money spent to acquire or upgrade physical assets such as construction of concrete and masonry dams, reservoirs, spillways, canals and distributory networks of the irrigation project during a financial year. The Working Expenses refer to non plan expenditure incurred on Direction and Administration, Machinery and Equipment, Training, survey and investigation, research and other expenditures during the financial year on different economic activities carried out for construction of irrigation projects. The revenue expenditure was incurred on a spectrum of activities like Direction and Administration, Procurement of Machinery and Equipment, Maintenance and Repair and Extension and Improvement of Completed Projects, Survey and Investigation and Construction Activities for new projects, Training and Research and other expenditure etc. Similarly, the expenditure incurred to meet day to day affairs of projects and petty expenses were booked under Miscellaneous Account termed as General/ Other Expenditure. It is reliably understood that expenditure incurred on Maintenance and Repair and Extension and Improvement of Completed Projects and expenditure incurred on projects those are yet to be approved by competent authority of Central and State Government are also included under Other Expenditure. Besides these activities, the expenditure not appropriately booked under a specific head of accounts is kept under Suspense Account. Similarly, Gross Receipt is the revenue receipt on account of water charges and other levy as imposed by the state Government from time to time. In case of Minor Irrigation projects Working Expenses refer to a spectrum of activities like (i) construction of Water Tank, Lift Irrigation, Tribal Sub-Plan and Other Expenditures under Surface Water schemes/ projects, (ii) Survey and Investigation, construction of Tube wells/ subsidy to beneficiaries and Other Expenditures in Ground Water schemes and (iii) Direction and Administration, Procurement of Machinery and Equipments, Tribal Sub-Plan and Other Expenses in general for Minor Irrigation projects. The Working Expenses in Command Area Development Programme consist of Direction and Administration, Ayacut Development, Dry Land Development, Development of Hill Areas/ Desert Area, Tribal Area Sub-Plan and Other Expenses. The Command Area Development Programme per se take up activities like construction of field channels, lining of channels, land levelling and warabandi of small catchments areas besides removal of alkalinity and salinity of land for agriculture use. The terminology of Ayacut and Dry Land development etc. conforms to construction of field channels, land levelling and other activities as mentioned above.

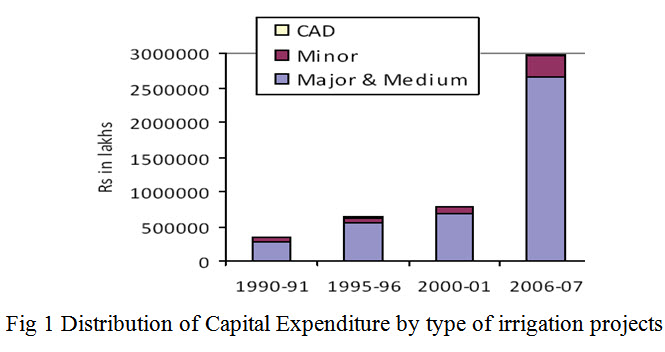

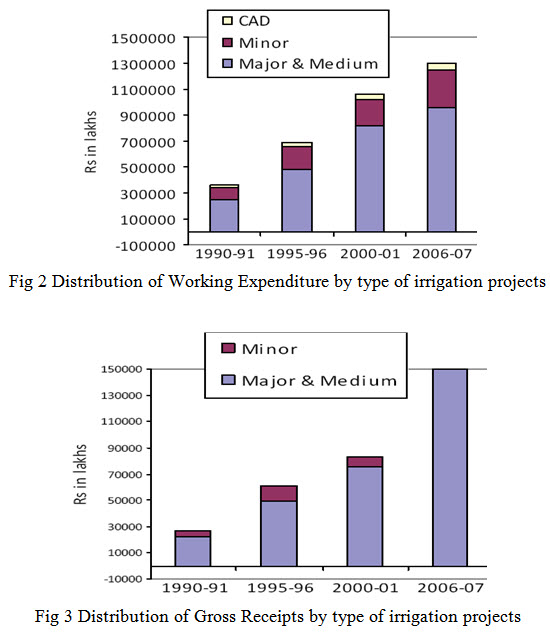

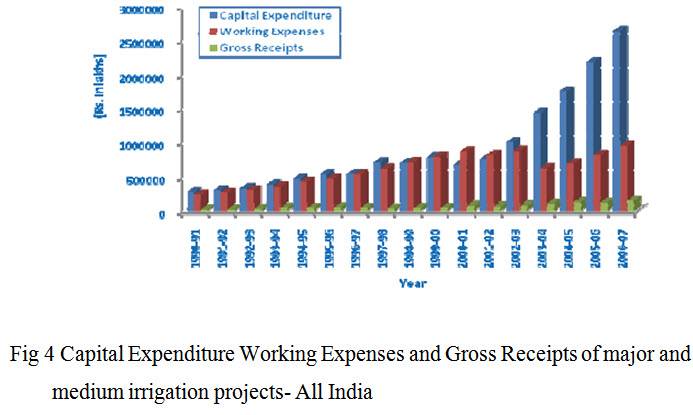

The quinquennial distribution of Capital Expenditure, Working Expenses and Gross Receipts at all- India level by type of irrigation are presented in charts Fig.1, Fig.2 and Fig.3.

These charts show that the share of types of irrigation projects in total Capital Expenditure, or Working Expenses or Gross receipts are more or less similar. The major and medium irrigation projects account for the major portion of expenditure, followed by Minor Irrigation and then by CAD. However, the total amounts for each of these characteristics are of different scale.

8.2 Major and Medium Irrigation projects

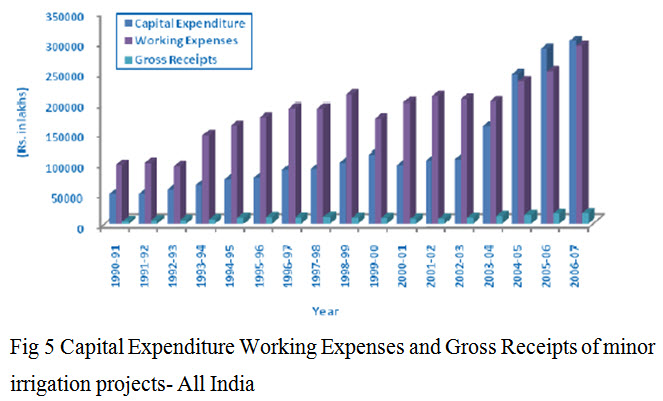

The Annual Capital Expenditure on major and medium irrigation projects has an increasing trend during the period 1990-91 to 2006-07. It was Rs.284638 lakh in 1990-91 and increased to Rs. 2654223 lakh in 2006-07. Similarly, the Annual Working Expenses for major and medium irrigation projects also depicted an increasing trend from Rs. 245219 lakh to Rs. 960443 lakh during the same period. The component "Direction and Administration" of Working Expenses also shows an increasing trend. It was only 8% in 1990-91 and increased to 25% in 2006-07. In absolute terms, the amount increased almost 12 times during the same period. The Gross Receipts from these projects on account of water charges and other economic activities are in the range of 5% to 12% of Capital Expenditure during 1990-91 to 2006-07.

8.3 Minor Irrigation Projects

The Capital Expenditure on minor irrigation projects shows an increasing trend over the period 1990-91 to 2006-07. During the period it has increased from Rs. 48858 Lakh to Rs. 302036 lakh. Similarly, the annual Working Expenses for minor irrigation projects also increased from Rs. 97480 lakh in 1990-91 to Rs. 293271 lakh in 2006-07. The Working Expense on Direction and Administration in 2006-07 was almost 10 times of the corresponding year in 1990-91. The expenditure incurred on Direction and Administration was 5% to 18% of Working Expenses. The Gross Receipts from minor irrigation projects on account of water charges and other levy are in the range of 6% to 15% of Capital Expenditure during 1990-91 to 2006-07.

8.4 Command Area Development Programmes

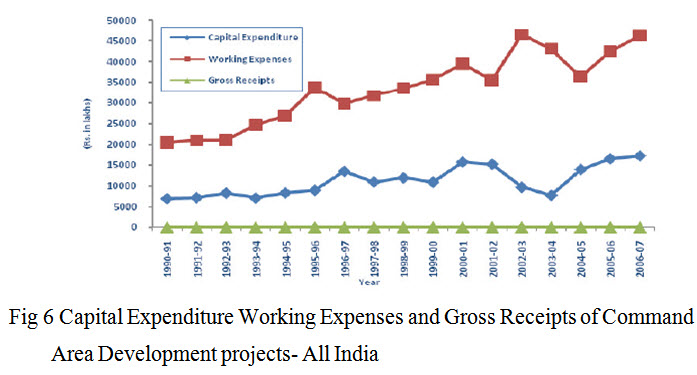

The annual Capital Expenditure on command area development programmes has an increasing trend. It was Rs. 6965 lakh in 1990-91 and Rs. 17295 lakh in 2006-07. Similarly, the annual Working Expenses has increased from Rs. 20498 lakh to Rs. 46152 lakh during the period.

The entire Working Expenses have been booked under Ayacut Development and ‘Other Expenditure’ except nominal expenses on Direction and Administration during 1990-91 to 2006-07, except 2002-03, 2005-06 and 2006-07. The Gross Receipt on account of water charges and other levy is reported nil.

8.5 Definition of Financial terms

The Major, Medium Irrigation and Multipurpose Projects have been initiated since beginning of the Plan era. There are 166 major, 222 medium and 89 ERM projects spill over in XI plan and 78 major, 146 medium and 86 ERM new projects are also to be completed during XI Plan. Several Major, Medium Irrigation and Multipurpose projects are spill over to subsequent Five Year Plans and are yet to be completed. Planning Commission has approved 250 additional Major and Medium Irrigation projects for implementation. Standard definitions and interpretations of these terms used, either in physical or financial term:

8.5.1. Revenue Receipt: Amount received for taxes, fees, permits, licenses, interest, intergovernmental sources and other sources during the fiscal year. Revenue or Revenues is income that a Government Department/ company receive from its normal business, activities, usually from the sale of goods and services to customers. Some Government Department/ companies also receive revenue from interest, dividend or royalties paid to them by beneficiaries/ other companies. Revenue may refer to business income in general or it may refer to the amount in a monetary unit, received during a period of time.

8.5.2. Revenue Expenditure: The Revenue Expenditure deals with the proceeds of taxation and other receipts classified as revenue and the expenditure met there from, the net result of which represents the revenue surplus or deficit for the year. The Revenue expenditure also deals with expenditure met usually from borrowed funds with the object of increasing concrete assets of a material and permanent character. It also includes receipt of a capital nature intended to be applied as a set off against expenditure.

8.5.3. Capital Expenditure: Expenditure made for an asset with a useful life of more than one year that increases the value or extends the useful life of the asset. Capital expenditure generally may not be deducted in the year they are paid, even if they are paid in connection with a trade or business. In other words, they are capitalised and generally may be depreciated or amortized in succeeding years.

8.5.4. Working Expenses: Money spent for creation asset/ infrastructure in a fiscal year by a Government Department to add or expand infrastructure, plant and equipment assets and upkeep them with the expectation that they will benefit the Government Department over a long period of time.

8.5.5. Gross Receipt: Gross receipts are the total amounts the organisation received for taxes, fees, permits, licenses, interest, intergovernmental sources and other sources during the fiscal year during its annual accounting period without subtracting any costs or expenses.

8.5.6. Recurring Working Expenses: Money spent for upkeep of asset/ infrastructure in a fiscal year by a Government Department to add or expand life of infrastructure, plant and equipment assets and upkeep them with the expectation that they will benefit the Government Department over a long period of time.

8.5.7. Direction and Administration: All expenditure from Plan / Non-plan budget incurred on establishment like salaries, office expenses, travel expenses and others in a fiscal year by a Government Department is termed as Direction and administration.

8.5.8. Machinery and Equipment: Machinery and Equipment are tools for facilitating delivery of manual works through mechanical device and at accurate speed and time.

8.5.9. Other Expenditure: Money spent on different instrument of expenditure in a fiscal year by a Government Department but not elsewhere classified in specific component of expenditure are termed as Other Expenditure. Money spent to acquire or upgrade physical assets such as construction of concrete and masonry dams, reservoirs, spillways, canals and distributory networks of the irrigation project during a financial year.

8.5.10. Recovery of Revenue: Recovery of Revenue are the total amounts the organisation levy through taxes, fees, permits, licenses, interest, intergovernmental sources and other sources during the fiscal year during its annual accounting period.

The state wise details of Capital Expenditure Working Expenses and Gross Receipts of Command Area Development projects are available in “Financial aspects of Irrigation Projects in India - May 2010”, Information Technology Directorate, Information Systems Organisation, Water Planning & Projects Wing, Central Water Commission, New Delhi at

Table 8.1 Gap between actual and potential Gross Receipts

|

Sl.No. |

State |

MMI potential created |

Potential ISF collection at Rs1350/ha (Rs crore/ year) |

Gross receipts (including from non‐irrigation users) 2006‐7 (Rs crore) |

|

1 |

Andhra Pradesh |

3303 |

445.9 |

68.8 |

|

2 |

Bihar |

2680 |

361.8 |

12.9 |

|

3 |

Gujarat |

1430 |

193.1 |

330.6 |

|

4 |

Haryana |

2099 |

283.4 |

87.2 |

|

5 |

Karnataka |

2121 |

286.3 |

21.5 |

|

6 |

Kerala |

609 |

82.2 |

4.9 |

|

7 |

Madhya Pradesh |

1387 |

187.2 |

29.8 |

|

8 |

Maharashtra |

3239 |

437.3 |

444.9 |

|

9 |

Orissa |

1827 |

246.6 |

49.8 |

|

10 |

Punjab |

2452 |

331.0 |

49.8 |

|

11 |

Rajasthan |

2482 |

335.1 |

20.1 |

|

12 |

Tamil Nadu |

1549 |

209.1 |

28.5 |

|

13 |

Uttar Pradesh |

7910 |

1067.9 |

148.6 |

|

14 |

West Bengal |

1683 |

227.2 |

69.5 |

|

|

Total |

34771 (94%) |

4694.1 |

1366.9 |

|

|

Other states |

2275 |

307.1 |

137.6 |

|

|

Total |

37046 |

5001.2 |

1504.5 |

Source: Table 5.4 http://planningcommission.nic.in/aboutus/committee/wrkgrp12/wr/wg_major.pdf