Site pages

Current course

Participants

General

Module 1. History and types of greenhouse

Module 2.Function and features of greenhouse

Module 3.Scope and development of greenhouse techn...

Module 4.Location, planning and various components...

Module 5.Design criteria and calculations

Module 6. Construction materials and methods of co...

Module 7. Covering material and characteristics

Module 8. Solar heat transfer

Module 9. Solar fraction for greenhouse

Module 10. Steady state analysis of greenhouse

Module No. 11 Greenhouse Heating, Cooling, Sheddin...

Module 12. Carbon dioxide generation and monitorin...

Module 13. Instrumentation and & computerized ...

Module 14. Watering, fertilization, root substrate...

Module 15. Containers and benches

Module 16. Plant nutrition, Alternative cropping s...

Module 17. Plant tissue culture

Module 18. Chemical growth regulation

Module 19. Disease control, integrated pest manage...

Module 20: Post Production Quality and Handling

Module 21: Cost analysis of greenhouse Production

Module 22. Application of greenhouse & its rep...

Lesson 31 Cost Analysis of Greenhouse Production

31.1 INTRODUCTION

Growing crops in a greenhouse environment requires a substantial investment in capital and management resources. The two financial considerations regarding any such enterprise are profitability and cash flow. Profitability potential can be addressed through an enterprise budget, which is an itemization of costs incurred over a typical or average production cycle. The second consideration is addressed by analyzing cash flows in and out of the enterprise for a fixed interval of time, that is, through a cash flow budget.

Greenhouse enterprise budgets contain two types of costs, variable and fixed. Variable costs are those costs incurred only if the production cycle is started. Seeds, fertilizer and perlite bags are examples of such costs. Fixed costs occur whether or not there is production. Property taxes, insurance, depreciation and interest on investment such as buildings and equipment are examples of fixed costs and must be accounted for even if there is no production. An enterprise budget can be used to estimate the profitability of an enterprise by including sales revenue and net returns. Net returns will be expressed as gross margin and net income. Gross margin is expressed as revenue minus variable cost and net income is revenue minus all costs. Enterprise budgets do not address whether the enterprise can produce a sufficient flow of funds to meet the cash obligations of the enterprise.

Cash flow analysis is used to determine whether the cash generated from operations (cash inflow) will be adequate to meet the cash outlays required to operate the enterprise (cash outflow) over a given time interval. Unpaid family labor is charged to the enterprise as an expense because it represents the loss of opportunity for the family member to work elsewhere and earn income. Consequently, while not a cash outlay, it should be charged as an opportunity cost to the enterprise. Both enterprise and cash flow budgets for greenhouse tomato production for one greenhouse are presented as an example in the following tables and discussed and analyzed. While this discussion uses tomato as a crop example, the principles discussed are applicable to other crops such as pepper, cucumber and eggplant. This particular example was chosen to illustrate several important aspects of greenhouse production and marketing that affect profitability such as market price, yield and labor.

31.2.1 Computation of Individual Cost Components

31.2.1.1 Interest on Investment:

Interest is defined as a sum paid or calculated for the use of capital. The sum is usually expressed in terms of a rate or percentage of the capital involved, called the interest rate. Interest is charged for the use of investment capital. Had the capital not been invested to buy a specific asset, it could have been used elsewhere, either within or outside the firm and would have brought some additional return to the firm. However, for the purposes of the study, use actual paid capital interest to arrive at capital costs.

31.2.1.2 Depreciation:

Depreciation is defined as the loss in value of an asset over time, mainly as a result of obsolescence. In the case of buildings and equipment, it is that portion of the decrease in value resulting from the passage of time. Obviously, part of the reduced value of the buildings and equipment is the result of usage and is considered a variable cost. The entire depreciation is considered a fixed cost.

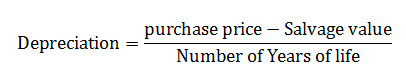

For computing depreciation, a 10 percent allowance or salvage value is generally taken from the purchase price of the buildings and equipment. The following formula is used in arriving at depreciation for buildings and equipment.

31.2.1.3 Land Value

Land associated with each greenhouse operation is valued as per local market condition. This value is determined through real estate values for good farmland suitable for a greenhouse operation. It can be argued that allocation of such a value distorts cost of land in and around urban areas relative to farmland. However, for uniformity and reasonable cost estimates, the land value should be standardized regardless of its location. Researchers are aware that land values in cities or towns are much higher than decided standardized value, but if market values are used for land acquired ten years ago, it would lead to artificially high fixed costs that would greatly inflate overall production costs.

31.2.1.4 Property and Business Taxes

Taxes on real estate include payments made on the assessed value of the greenhouse operation less any assessment for the greenhouse operator’s residence or operations other than the greenhouse. There is a business tax on greenhouses located in urban municipalities. Exact amounts of property and business taxes are included in the costs.

31.2.1.5. Labour Costs:

Hired labour costs include the amount of wages and any benefits received by the hired workers, such as contributions to Workers’ Compensation. The hours spent by the operator and his/her families in greenhouse production needs to be estimated.

31.2.1.6 Production Materials and Supplies:

Production materials and supplies include the purchase of cuttings, seed plants, fertilizers, chemicals, soils, vermiculite, perlite, peat moss, straw, peat pots and plastic.

31.2.1.7 Heating Cost:

Almost all greenhouse operators have reasonably accurate costs for heating the greenhouses with natural gas. Monthly bills are helpful in arriving at the total heating costs.

31.2.1.8 Utility Costs

Utility costs include electricity, telephone and water. If utility bill is combined with the greenhouse operator’s residence, the operator is asked to apportion the bill to arrive at total utility costs for the greenhouse operation.

31.2.1.9 Transportation Expenses:

Expenses for trucks or other vehicles owned by greenhouse operators are apportioned according to their use in the greenhouse operation, personal and leisure driving. Freight charges paid to commercial or private carriers for hauling greenhouse produce or supplies should be included in the transportation expenses

31.2.1.10 Repairs and Maintenance Cost

Maintenance costs include repairs to greenhouse structures, boilers, heating equipment, tractors and all other machinery and equipment associated with the greenhouse operation.

31.2.1.11 Marketing Charges:

These charges cover grading, packaging, marketing and administrative fees.

31.2.1.12 Miscellaneous costs:

These costs include legal and accounting fees, office supplies, bad debts, donations, membership fees, insurance costs and other costs incurred in a greenhouse operation, but not reported under any other heading.

31.2.2 Components of Cost Analysis

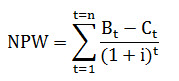

31.2.2.1 Net Present Worth:

The NPW is defined as the difference between present worth of savings and cost of investment. The mathematical statement for net present worth can be written as:

……………(Kothari et.al. 2001)

Where,

Ct= cost of each year

Bt= Benefit in each year

t= 1, 2, 3,……….n

i= discount rate

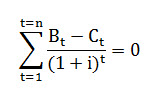

31.2.2.2 Internal Rate of Return:

The internal rate of return is threshold rate at which the NPW is zero. Internal rate of return is the discount rate (i) such that

…………… (Jain et.al.2004)

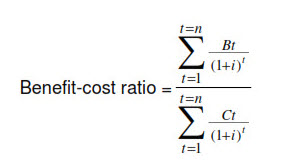

31.2.2.3 Benefit Cost Ratio

This ratio was obtained when the present worth of the benefit stream was divided by the present worth of the cost stream. The mathematical benefit-cost ratio (Kothari et. al., 2006) can be expressed as:

31.2.2.4 Payback Period

The payback period is the length of time from the beginning of the project until the net value of the incremental production stream reaches the total amount of the capital investment. It shows the length of time between cumulative net cash outflow recovered in the form of yearly net cash inflows.

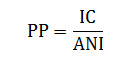

…………… Chito F.Sace, (2007)

Where,

PP= Payback Period

IC= Investment Cost

ANC= Annual Net Income

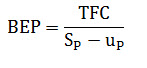

31.2.2.5 Break- Even Analysis (Chito F. Sace, 2007 )

Break-even analysis presents the point where there is just sufficient revenue to cover the costs. It is the point at which the total cost and the total gross revenue intersect. It is a method used more frequently to demonstrate the probable effects of change than to determine what those changes should be.

Where,

BEP= Break- Even Point; the volume where Tr=Tc

TFC= total fixed Cost Per Year

Sp= selling price per Kg

up = Cost per Kg

= TVC/(Total wt./year)

REFERENCES:

Smith et.al. 1990.“A Profitability and Cash Flow Analysis of Typical Greenhouse Production in North Florida Using Tomato as an Example.” Florida Greenhouse Vegetable Production Handbook, Vol 3.

S.H.Sengar and S.kothari (2008). “Economic evaluation of greenhouse for cultivation of rose nursery.” African Journal of Agricultural Research, Vol. 3 (6), pp. 435-439.

Chito F.sacel, (2007). “Greenhouse Economics.” Philippine Agricultural Mechanization Bulletin.