Site pages

Current course

Participants

General

MODULE 1. Introduction to production of agricultur...

MODULE 2. Advance in material for tractor and agri...

MODULE 3. Advanced manufacturing techniques

MODULE 4. Heat treatment of steel

MODULE 5. Industrial lay out planning and quality ...

MODULE 6. Economics of process

MODULE 7. Techno economic feasibility of project r...

MODULE 8. Servo motors, drives and controllers

MODULE 9. CNC controllers for machine tools

MODULE 10. CNC programming

MODULE 11. Assembly and plant automation storage a...

LESSON 19. ECONOMICS OF PROCESS SELECTION

1.1 Introduction

Design engineers, manufacturing engineers, and industrial engineers, in analyzing alternative methods for producing a part or a product or for performing an individual operation or an entire process, are faced with cost variables that relate to materials, direct labor, indirect labor, special tooling, perishable tools and supplies, utilities, and invested capital. The interrelationship of these variables can be considerable, and therefore, a comparison of alternatives must be detailed and complete to assess properly their full impact on total unit costs.

1.2 Materials

The unit cost of materials is an important factor when the methods being compared involve the use of different amounts or different forms of several materials. For example, the materials cost of a die-cast aluminum part probably will be greater than that of a sand-cast iron part for the same application. An engineering plastic for the part may carry a still higher cost. Powder-metal processes use a smaller quantity of higher-cost materials than casting and machining processes. In addition, yield and scrap losses may influence materials cost significantly.

1.3 Direct Labor

Direct labor unit costs essentially are determined by three factors: the manufacturing process itself, the design of the part or product, and the productivity of the employees operating the process or performing the work. In general, the more complex the design, the closer the dimensional tolerances, the higher the finish requirements, and the less tooling involved, the greater the direct labor content will be.

The number of manufacturing operations required to complete a part probably is the greatest single determinant of direct labor cost. Each operation involves a “pick up and locate” and a “remove and set aside” of the material or part, and usually additional inspection by the operators is necessary. In addition, as the number of operations increases, indirect costs tend to accelerate. The chances for cumulative dimensional error are increased owing to changing locating points and surfaces. More setups are required; scrap and rework increase; timekeeping, counting, and paperwork expand; and shop scheduling becomes more complex.

Typical of low-labor-content processes are metal stamping and drawing, die casting, injection molding, single-spindle and multispindle automatic machining, numerical and computer-controlled drilling, and special-purpose machining, processing, and packaging in which secondary work can be limited to one or two operations. Semiautomatic and automatic machines of these types also offer opportunities for multiple-machine assignments to operators and for performing secondary operations internal to the power-machine time. Both can reduce unit direct labor costs significantly. Processes such as conventional machining, investment casting, and mechanical assembly including adjustment and calibration tend to contain high direct labor content.

1.4 Indirect Labor

Setup, inspection, material handling, tool sharpening and repairing, and machine and equipment maintenance labor often are significant elements in evaluating the cost of alternative methods and production designs. The advantages of high-impact forgings may be offset partially by the extra indirect labor required to maintain the forging dies and presses in proper working condition. Setup becomes an important consideration at lower levels of production. For example, it may be more economical to use a method with less setup time even though the direct labor cost per unit is increased. Take a screw-machine type of part with an annual production quantity of 200 pieces. At this volume, the part would be more economically produced on a turret lathe than on an automatic screw machine. It’s the total unit cost that is important.

1.5 Special Tooling

Special fixtures, jigs, dies, molds, patterns, gauges, and test equipment can be a major cost factor when new parts and new products or major changes in existing parts and products are put into production. The amortized unit tooling cost should be used in making comparisons. This is so because the unit tooling cost, limited by life expectancy or obsolescence, is very production-volume-dependent. With high production volume, a substantial investment in tools normally can be readily justified by the reduction in direct labor unit cost, since the total tooling cost amortized over many units of product results in a low tooling cost per unit. For low-volume-production applications, even moderate tooling costs can contribute relatively high unit tooling costs.

In general, it is conservative to amortize tooling over the first 3 years of production. Competition and progress demand improvements in product design and manufacturing methods within this time span. In the case of styled items, the period may need to be shortened to 1 or 2 years. Automobile grilles are a good example of items that traditionally have had a production life of two years, after which a restyled design is introduced.

1.6 Perishable Tools and Supplies

In most cost systems, the cost of perishable tools such as tool bits, milling cutters, grinding wheels, files, drills, taps, and reamers and supplies such as emery paper, solvents, lubricants, cleaning fluids, salts, powders, hand rags, masking tape, and buffing compounds are allocated as part of a cost-center manufacturing-overhead rate applied to direct labor. It may be, however, that there are significant differences in the use of such items in one process when compared with another. If so, the direct cost of the items on a unit basis should be included in the unit-cost comparison. Investment casting, painting, welding, and abrasive-belt machining are examples of processes with high costs for supplies. In the case of cutoff operations, it is more correct to consider the tool cost per cut as an element in a comparison. Cutting-tool costs for other types of machining operations also may constitute a major part of the total unit cost. The high cost and short tool life of carbide milling cutters for profile milling of “hard metals,” such as are used in jet-engine components, contribute significantly to the cost per unit. The hard metals include Inconel, refractory-metal alloys, and superalloy steels.

1.7 Utilities

Here again, as with perishable tools and supplies, the cost of electric power, gas, steam, refrigeration, heat, water, and compressed air should be considered specifically when there are substantial differences in their use by the alternative methods and equipment being compared. For example, electric power consumption is a major element of cost in using electric arc furnaces for producing steel castings. And some air operated transfer devices may increase the use of compressed air to a point at which additional compressor capacity is needed. If so, this cost should be factored into the unit cost of the process.

1.8 Invested Capital

Obviously, it is easier and less risky for a company to embark on a program or a new product that utilizes an extension of existing facilities. In addition, the capital investment in a new product can be minimized if the product can be made by using available capacity of installed processes. Thus the availability of plant, machines, equipment, and support facilities should be taken into consideration as well as the capital investment required for other alternatives. In fact, if sufficient productive capacity is available, no investment may be required for capital items in undertaking the production of a new part or product with existing processes. Similarly, if reliable vendors are available, subcontracting may be an alternative. In this event, the capital outlays may be borne by the vendors and therefore need not be considered as separate items in the cost evaluation. Presumably, such costs would be included in the subcontract prices per unit.

On the other hand, there may be occasions when the production of a single component necessitates not only the purchase of additional production equipment but also added floor space, support facilities, and possibly land. This eventuality could occur if the present plant was for the most part operating near capacity with respect to equipment, space, and property or if existing facilities were not fully compatible with producing the component or product at a low unit cost.

When capital equipment costs are pertinent to the selection of a process, the unit cost calculations should assign to each unit of product its share of the capital investment based on the expected life and production from the capital item. For example, a die-casting machine that sells for $200,000, has an estimated production life of 10 years and an expected operating schedule of three shifts of 2000 h each per year, and is capable of producing at the rate of 100 shots per hour with a two-cavity mold, less a 20 percent allowance for downtime for machine and die maintenance and setups, would have a capital cost per unit as follows:

$200,000

Capital cost = ---------------------------------------- = $ 0.020 per piece

10x3x2000 x100x2 (100%-20%)

This calculation assumes that the machine will be utilized fully by the proposed product or other production. Also, the computation does not include any interest costs. Interest charges for financing the purchase of the machine should be added to the purchase price. If interest costs of $50,000 over the life of the machine are assumed, the capital cost per unit would be $0.025 instead of $0.020. This type of calculation is applicable solely to provide a basis for choosing between process alternatives and is simpler and different from the analysis involved in justifying the investment once the process selection has been made.

1.9 Other Factors

Occasionally, a special characteristic of one or several of the processes under consideration involves an item of cost that may warrant inclusion in the unit-cost comparison. Examples of this type might include costs related to packaging, shipping, service and unusual maintenance, and rework and scrap allowances. The important point is to recognize all the essential differences between the alternatives and to allow properly for these differences in the unit-cost comparison. Remember that the objective is to determine the most economical process for a given set of conditions, i.e., the process that can be expected to produce the part or product at the lowest total unit cost for the anticipated sales volume.

Also, in making a unit-cost comparison between several alternatives, it is necessary to include in the analysis only those costs which differ between alternatives. For example, if all choices involve the same kind and amount of material, the materials cost per unit need not be included in the comparison.

Further, when available capacity exists on production equipment used for similar components, the choice of process may be obvious. This is especially true when the production quantity for the new part or product is not high. The opportunity for utilizing available capacity makes an additional investment in an alternative process difficult to justify

TYPICAL EXAMPLES

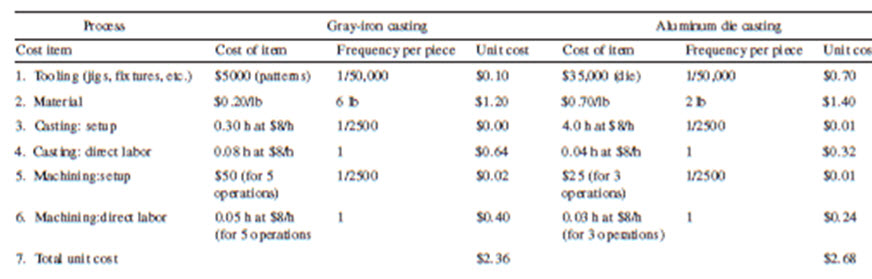

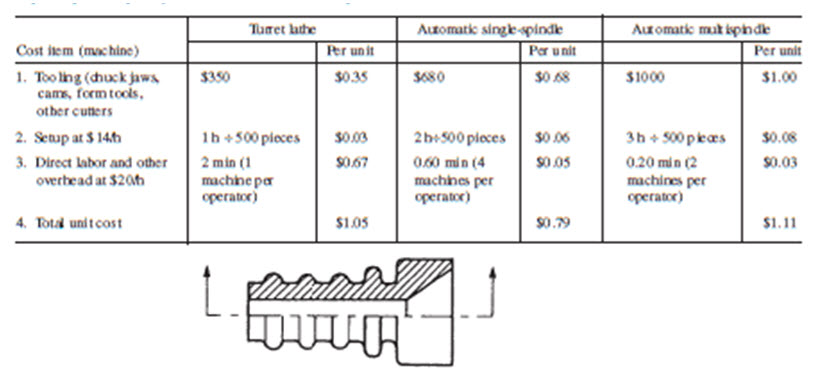

Exhibits 1.1 and 1.2 are examples showing a concise layout for comparing alternatives. Exhibit 1.1 compares sand mold casting with die casting for one part. Exhibit 1.2 considers making a part on a turret lathe versus single spindle and multi spindle automatic screw machines. Neither of these examples attempts to justify the purchase of machines or equipment. These examples assume that the processes are installed and have available capacity for additional production. Note that the production quantity is an important factor in determining the most economical process. In both illustrations, as the production quantity increases, the unit cost comparison begins to favor a different alternative.

EXHIBIT 1.1 Sand-Mold Casting versus Die Casting

Part: New model pump housing Annual quantity: 10,000 pieces

Expected product life: 5 years Normal lot size: 2500 pieces

EXHIBIT 1.2 Turret Lathe versus Single-Spindle and Multi spindle Automatic Screw Machines (Excluding Secondary Operations)

Part: High-pressure hose fitting Annual quantity: 500 pieces

Expected product life: 2 years Normal lot size: 500 pieces

Reference: Frederick w. hornbruch, jr. Design for manufacturability handbook,laguna hills, california (www.digitalengineeringlibrary.com)