Site pages

Current course

Participants

General

Module 1: Basics of Agricultural Drainage

Module 2: Surface and Subsurface Drainage Systems

Module 3: Subsurface Flow to Drains and Drainage E...

Module 4: Construction of Pipe Drainage Systems

Module 5: Drainage for Salt Control

Module 6: Economics of Drainage

Keywords

Lesson 16 Economic Evaluation of Drainage Projects

16.1 Introduction

Land drainage is generally undertaken either to bring land into production or to increase the productivity of existing cultivable land. It represents a capital investment intended to result in future benefits and the viability of the drainage project should be assessed like any other investment on the basis of sound economic analysis. Economic evaluation of any projects/schemes calls for the comparison of benefits and costs. However, which items should be regarded as benefits and costs and how they should be valued depends at least partly on the outcome of planning process in other strata of the economy (Smedema and Rycroft, 1983). Thus, a proper identification of costs and benefits is the key to any economic analysis.

The costs of a drainage project can conveniently be grouped under the following heads (ILRI, 1974):

Initial or capital investments: Examples of capital investments are: canals, control works, ditches, pipes, pumps, land leveling, land clearing, farm roads, reallocation of existing structures, etc.

Replacement investments: They are required in the future when capital goods come to the end of their technical or economic lifetime and have to be replaced.

Loss of existing property.

Recurrent costs of the maintenance works.

Recurrent costs of the operation and management of a scheme.

Other associated costs.

The benefits of land drainage may be divided into following two major heads:

Tangible benefits: Examples of tangible benefits are: enhanced agricultural production, water supply for domestic or industrial use, etc.

Intangible benefits: Examples of intangible benefits are: improvement in local environment, improved hygiene, better trafficability, etc.

16.2 Computation of Costs and Benefits for Economic Analysis

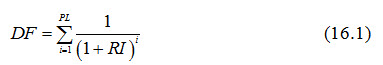

16.2.1 Computation of Discounting Factor

The costs and the benefits of a land drainage project occur at different times during the project period; the main cost occurring mostly during the construction phase and the benefits after the project has reached maturity. Hence, there is a need for some device to bring the benefits and costs occurring at different points of time on to a common base; otherwise no comparisons are possible. This device is called discounting. Numerically, discounting is the inverse of charging compound interest. It is calculated using the following equation (Finkel, 1983):

Where, DF = discounting factor, PL = life of the drainage project (years), and RI = rate of interest (fraction).

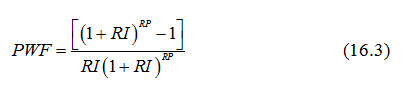

16.2.2 Computation of Annual Repayment

The annual repayment on the initial loan at a rate of interest and over a repayment period is calculated as (Finkel, 1983):

Here, PWF (present worth factor) is equal to:

Where, F = annual repayment (Rs.), IC = initial investment (Rs.), RP = repayment period (years), and the remaining symbols have the same meaning as defined earlier.

16.2.3 Inflation Factor Computation

Rate of the money can increase the future costs and benefits are increased in value to take account of an assumed rate of inflation. Yearly inflation factor is calculated by:

Where, IF = inflation factor, IR = inflation rate (fraction), and the remaining symbols have the same meaning as defined earlier.

16.3 Indices for Economic Evaluation

In practice, three principal indices are used in an economic analysis: (i) net present value (NPV), (ii) benefit-cost ratio (B-C ratio), and (iii) internal rate of return (IRR). A brief description about these economic indices is given below.

16.3.1 Net Present Value (NPV)

Net Present Value (NPV) is the difference between the present value of benefits and costs. It also known as Net Present Worth (NPW). Clearly, a positive value of NPV (or NPW) is desirable (Smedema and Rycroft, 1983). The formula for the computation of NPV is (ILRI, 1974; Brooks et al., 1997):

Where, Bi = benefits in the ith year (Rs.), Ci = cost in the ith year (Rs.), and the remaining symbols have the same meaning as defined earlier.

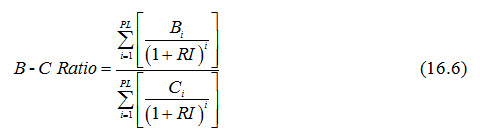

16.3.2 Benefit-Cost Ratio (B-C Ratio)

Benefit-Cost Ratio (B-C Ratio) is the present value of benefits divided by present value of costs. For a project to be economically viable, the B-C ratio should be greater than one (Smedema and Rycroft, 1983). The benefit-cost ratio is computed as (Brooks et al., 1997):

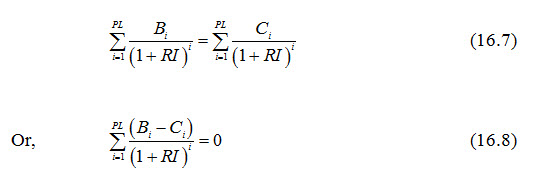

16.3.3 Internal Rate of Return (IRR)

Internal Rate of Return (IRR) is often used for large public projects (Smedema and Rycroft, 1983). Unlike the NPV or B-C ratio, the IRR does not use a predetermined discount rate. Rather, IRR is the discount rate that sets the present value of benefits equal to the present value of costs. That is (Brooks et al., 1997),

16.3.4 Capital Recovery Factor (CRF)

A more precise method for computing the annual amortized fixed cost is to take into account the expected service life of the project/item and the interest rate. In this method, the fixed cost is based on the present worth multiplied by the ‘capital recovery factor’. Capital Recovery Factor (CRF) is defined as the ratio of a constant annuity to the present value of receiving that annuity for a given time period. It is mathematically expressed as (James and Lee, 1971):

Where, i = rate of interest (fraction), and n = anticipated service life of the drainage project (years).

16.3.5 Selection of Suitable Economics Indices

All three economic measures viz., NPV, B-C Ratio and IRR are calculated using the same benefit and cost data and assumptions, and have symmetry in their results. It is possible that when a set of alternative projects is examined, the use of different evaluation indices will give different project ranking. This raises the question as to which economic indices to use. A comparative analysis of these three economic indices is presented in Table 16.1, which can help drainage engineers during economic analysis of drainage projects.

Table 16.1. Comparison between three widely used economic indices (Brooks et al., 1997)

|

Project Condition |

NPV |

IRR |

B-C Ratio |

|

1. Independent Projects (no constraint on costs) |

Select all project with NPV>0; project ranking not required |

Select all projects with IRR greater than cutoff rate of return; project ranking not required |

Select all projects with B-C ratio>1; project ranking not required. |

|

2. Constraint on Costs |

Not suitable for ranking projects |

Ranking all projects by IRR may yield incorrect solution |

Rank all projects by B-C ratio where C is defined as constrained cost will always give correct ranking. |

|

3. Mutually Exclusive Projects (within a given budget) |

Select alternative with largest NPV |

Selection of alternative with highest IRR may give incorrect result |

Selection of alternative with highest B-C ratio may give incorrect result. |

|

4. Discount Rate |

Appropriate discount rate must be adopted |

No discount rate required, but reference rate must be adopted |

Appropriate discount rate must be adopted. |

16.4 Example Problem on Economic Analysis of Drainage Projects

Problem: The following data are given for land drainage systems (Smedema and Rycroft, 1983):

Total costs of drainage systems = 520 £/ha

Maintenance costs of drainage systems = 5 £/ha

Rate of interest = 10 % /year

Repayment period = 10 years

Inflation rate = 5 %

Life of drainage project = 20 years

Total benefits = 90 £/ha

Solution: The solution to the above problem is presented in Table 16.2.

Table 16.2. Results of the cost and benefit analysis of a drainage project

|

Year |

Costs and Benefits at Actual Prices (£/ha) |

Actual Future Costs and Benefits with 5% Inflation (£/ha) |

Present Values of Future Sums (£/ha) |

||||||||

|

Loan |

Maintenance of Moling |

Benefits |

Inflation Factor |

Loan |

Moling Main-tenance |

Benefits |

Benefits - Costs |

Discount Factor 10% |

Benefits - Costs |

NPV |

|

|

1 |

84.60 |

|

90 |

1.05 |

84.60 |

|

94.50 |

9.90 |

0.91 |

9.00 |

9.00 |

|

2 |

84.60 |

|

90 |

1.10 |

84.60 |

|

99.00 |

14.40 |

0.83 |

12.00 |

21.00 |

|

3 |

84.60 |

|

90 |

1.16 |

84.60 |

|

104.40 |

19.80 |

0.75 |

14.90 |

35.90 |

|

4 |

84.60 |

|

90 |

1.22 |

84.60 |

|

109.80 |

25.20 |

0.68 |

17.10 |

53.00 |

|

5 |

84.60 |

15 |

90 |

1.28 |

84.60 |

19.20 |

115.20 |

11.40 |

0.62 |

7.10 |

60.00 |

|

6 |

84.60 |

|

90 |

1.34 |

84.60 |

|

120.60 |

36.00 |

0.56 |

20.20 |

80.30 |

|

7 |

84.60 |

20 |

90 |

1.41 |

84.60 |

28.20 |

126.90 |

14.10 |

0.51 |

7.20 |

87.50 |

|

8 |

84.60 |

|

90 |

1.48 |

84.60 |

|

133.20 |

48.60 |

0.47 |

22.80 |

110.30 |

|

9 |

84.60 |

|

90 |

1.55 |

84.60 |

|

139.50 |

54.90 |

0.42 |

23.10 |

133.40 |

|

10 |

84.60 |

15 |

90 |

1.63 |

84.60 |

24.50 |

146.70 |

37.60 |

0.39 |

14.70 |

148.10 |

|

11 |

|

|

90 |

1.71 |

|

|

153.90 |

153.90 |

0.35 |

53.90 |

202.00 |

|

12 |

|

|

90 |

1.80 |

|

|

162.00 |

162.00 |

0.32 |

51.90 |

253.90 |

|

13 |

|

|

90 |

1.89 |

|

|

170.10 |

170.10 |

0.29 |

49.30 |

303.20 |

|

14 |

|

20 |

90 |

2.00 |

|

40.00 |

180.00 |

140.00 |

0.26 |

34.40 |

335.60 |

|

15 |

|

15 |

90 |

2.08 |

|

31.20 |

187.20 |

154.50 |

0.24 |

37.10 |

376.70 |

|

16 |

|

|

90 |

2.18 |

|

|

196.20 |

196.20 |

0.22 |

43.20 |

419.90 |

|

17 |

|

|

90 |

2.29 |

|

|

206.10 |

206.10 |

0.20 |

41.20 |

461.10 |

|

18 |

|

|

90 |

2.41 |

|

|

216.90 |

216.90 |

0.18 |

39.00 |

500.10 |

|

19 |

|

|

90 |

2.53 |

|

|

227.70 |

227.70 |

0.16 |

36.40 |

536.50 |

|

20 |

|

15 |

90 |

2.65 |

|

39.80 |

238.50 |

198.70 |

0.15 |

29.80 |

566.30 |

|

B–C ratio after 10 years is (555.44+148.10)/555.44 = 1.27 while after 52 years is (566.30+581.90)/581.90 = 1.97 |

|||||||||||

References

Brooks, N.K., Ffolliott, P.F., Gregersen, H.M. and DeBano, L.F. (1997). Hydrology and the Management of Watersheds. Iowa State University Press, Ames, Iowa, pp. 302-305.

Finkel, H.J. (1983). CRC Handbook of Irrigation Technology. CRC Press, Inc. Boca Raton, Florida, pp. 1-10 and 61-75.

ILRI (1974). Drainage Principles and Applications. International Institute for Land Reclamation and Improvement, Wageningen, the Netherlands, Publication 16 (Vols. II and IV), 373 pp. and pp. 433-450.

James, L.D. and Lee, R.R. (1971). Economics of Water Resources Planning. McGraw-Hill, New York.

Smedema, L.K. and Rycroft, D.W. (1983). Land Drainage. Batsford Academic and Education Ltd., London.

Suggested Readings

James, L.D. and Lee, R.R. (1971). Economics of Water Resources Planning. McGraw-Hill, New York.

Schwab, G.O., Fangmeier, D.D., Elliot, W.J. and Frevert, R.K. (2005). Soil and Water Conservation Engineering. Fourth Edition, John Wiley and Sons (Asia) Pte. Ltd., Singapore.

Smedema, L.K. and Rycroft, D.W. (1983). Land Drainage. Batsford Academic and Education Ltd., London.