Site pages

Current course

Participants

General

Module- 1. Introduction of food plant design and ...

Module- 2. Location and site selection for food pl...

Module- 3. Food plant size, utilities and services

Module- 4. Food plant layout Introduction, Plannin...

Module- 5. Symbols used for food plant design and ...

Module- 6. Food processing enterprise and engineer...

Module- 7. Process scheduling and operation

Module 8. Building materials and construction

Lesson 3. Introduction to feasibility study and analysis

3.1 Pre selection/Pre-feasibility stage

The preliminary screening may have several ideas which appear to be worthy of further study. Since a complete feasibility study is time consuming and expensive, it may be desirable to perform a pre-feasibility analysis in order to further screen the possible ideas. The purpose of a pre-feasibility study is to determine.

Whether the project seems to justify detailed study

What matters deserve special attention in the detailed study (e.g. market analysis, technical feasibility, investment costs)

An estimate of cost for the detailed study

For many ideas the pre-feasibility analysis may provide adequate evidence of venture profitability if certain segments are more carefully verified. Emphasis depends on the nature of the product and the area of greatest doubt. In most cases market aspects and materials receive primary emphasis. The pre-feasibility study and report may include some or all of the following elements.

3.1.1 Product description: The product's characteristics should be briefly described, along with possible substitutes which exist in the market place. Also, allied products should be identified, which can or should be manufactured with the product under study.

3.1.2 Description of market: The present and projected potential market and the competitive nature of the market should be delineated.

Where is the product now manufactured?

How many plants exist and how specialized are they?

What are the national production, imports, and exports?

Are there government contracts or incentives?

What is the estimated product longevity or future consumption?

What is the price structure?

3.1.3 Outline of technological variants: The technology choices that exist for the manufacture of the product should be described briefly. Also, the key plant location factors should be identified.

3.1.4 Availability of main production factors: Production factors such as raw materials, water, power, fuel and labor skills should be examined to ensure availability.

3.1.5 Cost estimates: Estimates should be made of the necessary investment costs and costs of operation.

3.1.6 Estimate of profit: The data gathered should include estimates of profits of firms manufacturing similar products or, if the preliminary data are extensive, an actual estimated profit for the project under study.

3.1.7 Other data: In certain cases, local attitudes toward industry; educational, recreational and civic data; and availability of local sites, may be the most important in the evaluation of the suitability of a proposed product, especially in the case of the establishment of a new firm.

Thus pre-feasibility study can be viewed as a series of steps culminating in a document which permits determination of whether or not a complete detailed feasibility study should be made. It does not possess the depth the detailed study is expected to have, and the data usually are gathered in an informal manner.

3.2 Analysis stage

At the analysis stage various alternatives in marketing, technology and capital availability need to be studied. The analysis can be conducted at different levels of effort with respect to time, budget and personnel, depending on the circumstances. The complete study is referred to as techno-economic feasibility study. In some cases such a detailed study is not necessary. For example, if the product has an assured market, in-depth market analysis is not required. In some cases, a partial study of the market or of the technologies satisfies the data requirements for decision making. The detailed analysis should include the following.

3.2.1 Market analysis / study:

Market analysis can serve as a tool for screening venture ideas and also as a means of evaluating the feasibility of a venture idea in terms of the market. It provides:

understanding of the market

information on feasibility of marketing the product

analytical approach to the decision making

In addition, it assists in analyzing the decisions already taken. Market analysis answers questions about:

size of market and share anticipated for the product in terms of volume and value

pattern of demand

market structure

buying habits and motives of buyers

past and future trends

price which will ensure acceptance in the market

most efficient distribution channels,

company's strong points in marketing

Market analysis involves systematic collection, recording, analysis, and interpretation of information on:

existing and potential markets

marketing strategies and tactics

interaction between market and product

marketing methods

current or potential products

In collecting the market data, for whatever size market or type of product, it is helpful to follow an orderly procedure.

The initial step is to put down in writing a preliminary statement of objectives in as much detail as possible. A good procedure is to structure the objectives in question form. When setting objectives, always keep in mind as to how the information will be used when it is obtained. This helps in eliminating objectives that would not make a contribution to the market analysis.

3.2.2 Situational analysis related to market:

The situational analysis of the market involves analyzing the product's relationship to its market by using readily available information. The information reviewed and each question asked will give the analyst a feel for the situation surrounding the product. The state involves an informal investigation which includes talking to people in wholesale market, brokers, competitors, customers and other individuals in the industry. If this informal investigation produces the sufficient data to measure the market adequately, the analysis need not proceed further. Also, in some instances, where time is critical or where budget is a problem, the data gathered during the informal market analysis may be all that is available on which to base decisions.

Seldom do the data obtained during the situational analysis answer all the necessary questions. The informal analysis provides the basis for revision of the objectives and frequently indicates the most fruitful methods by which market can be studied. This also helps in preparing a comprehensive programme of market study. Such a programme should include a description of the tasks and methods by which each type of information is to be gathered. It should include not only the time schedule for each task, but also an estimate of costs likely to be incurred.

Basic steps involved in a market study for a new enterprise are:

Define objectives of the study and specify information required

Workout details of the study as under:

- identify sources of information (both secondary and primary)

- time and cost involvement

- methodology and action plan

Select samples and decide contacts and visits

Prepare the questionnaire as the survey instrument and field test the same

Conduct the survey and analyze information

Prepare the report with findings and interpretations

The analysis should generally contain:

A brief description of the market including the market area, methods of transportation existing rates of transportation, channels of distribution, and general trade practices

Analysis of past and present demand including determination of quantity and value of consumption, as well as identification of the major consumers of the product

Analysis of past and present supply broken down as to source, information on competitive position of the product such as selling prices, quality, and marketing practices of the competitors

Estimate of future demand of the product

Estimate of the project’s share of the market considering all above factors

3.2.3 Technical analysis:

The technical analysis must establish whether or not the identified venture is technically feasible and, if so, make tentative choices among technical alternatives and provide cost estimates in respect of:

fixed investment

manufacturing costs and expenses and

start-up costs and expenses

In order to provide cost estimates, tentative choices must be made among technical alternatives such as:

(i) level of product / manufacturing technology,

(ii) raw material inputs,

(iii) equipments,

(iv) methods,

(v) organization, and

(vi) facilities location and design.

The analysis report should incorporate:

Description of the product, including specifications relating to its physical, mechanical, and chemical properties as well as the uses of the product Description of the selected manufacturing process showing detailed flow charts as well as presentations of alternative processes considered and justification for adopting the one selected

Determination of plant size and production schedule, which includes the expected volume for a given time period, considering start-up and technical factors

Selection of machinery and equipment, including specifications, equipment to be purchased and origin, quotations from suppliers, delivery dates, terms of payment, and comparative analysis of alternatives in terms of costs, reliability, performance and spare parts availability

Identification of plant's location and assessment of its desirability in terms of its distance from raw material sources and markets. For a new project this part may include a comparative study of different sites, indicating the advantages and disadvantages of each

Design of a plant layout and estimation of the costs of erection of the proposed types of buildings and land improvements

Study of availability of raw materials and utilities, including a description of physical and chemical properties, quantities, needed, current and prospective costs, terms of payment, source of supply and their location and continuity of supply

Estimate of labour requirements including a breakdown of the direct and indirect labour supervision required for the manufacture of product

Determination of the type and quantity of waste to be disposed of, description of the waste disposal method, its costs and necessary clearance from the authorities

Estimation of the production cost for the product

The elimination of inappropriate technology alternatives for producing the identified product can be done on the basis of side effects. The factors which may be considered as side effects include:

contribution to employment

requirements for scarce skills

energy requirements

capital requirements

need for imported equipment

support of indigenous industry

multiplier effect of the venture operation

environmental effects

safety and health hazards

Information concerning manufacturing processes and equipment, which may facilitate the selection and decision making, may be obtained from: (i) existing manufacturers of the product, (ii) trade publications, (iii) trade associations and organizations, and (iv) equipment manufacturers.

3.2.4 Financial analysis:

The financial analysis emphasizes on the preparation of financial statement, so that the venture idea can be evaluated in terms of commercial profitability and magnitude of financing required. It requires the assembly of the market and the technical cost estimates into various proforma statements. If more information on which to base an investment decision is needed, a sensitivity analysis or, possibly, a risk analysis can be conducted. The depth of analysis would depend, to a certain extent, on the venture idea and the overall objectives of the feasibility analysis.

The financial analysis should include:

For existing companies-audited financial statements, such as balance sheets, income statements and cash flow statements

For new companies-statements of total project costs, initial capital requirements and cash flows relative to the project time table

For all projects-financial projections for future time periods, including income statements, cash flows and balance sheets

Supporting schedules for financial projections, stating assumptions used as to collection period of sales, inventory levels, payment period of purchases and expenses, elements of product costs, selling, administrative and financial expenses

financial analysis showing return on investment, return on equity, break- even volume and price analysis

Sensitivity analysis to identify items that have a large impact on profitability or possibility of risk analysis

The analyst may obtain profitability measures for the venture being studied in several ways. Common non-time value approaches to measure profitability are the pay back period and financial statement (accounting) rates of return. These rates of return are based on some net income figure divided by some investment base. Frequently used profitability measure of this type are: net income to assets, first-year earnings to initial investment, average net income to initial investment, and average net income to average investment.

Profitability measures, which consider the time value of money, that is, discounted cash flow methods, are net present value (NPV), internal rate of return (IRR), and the discounted benefit / cost ratio. When profitability measures other than financial statement rates of return are used as the investment decision criteria, the analyst needs estimates of the following:

the net investment, which is gross capital less any capital recovered from the sale or trade of existing assets

the operating cash flows, which are the after-tax cash flows resulting from the investment

the economic life of the venture, defined as the time period during which benefits can be obtained from the venture and

the appropriate discount rate.

With the relevant cash flows computed for the venture, the next step is to decide which investment decision criterion to use for the acceptance or rejection of ventures as well as their ranking. Theoretically, the net present value criterion is the best measure of profitability of the investment decision criteria used to evaluate new venture ideas, the internal rate of return appears as the technique to be of prime importance. The payback period is used primarily as a supplementary technique.

3.2.5 Sensitivity and risk analysis

Recognizing that the venture profitability forecast hinges on future developments whose occurrence can not be predicted with certainty, the decision- maker may want to probe further. The analyst may want to determine the impact of changes in variables such as product price, raw material costs, and operating costs on the overall results. Sensitivity analysis and risk analysis are the techniques that allow the analyst to deal with such problems.

The purpose of sensitivity analysis is to identify the variables that most affect the outcome of a venture. Sensitivity analysis is useful for determining consequences of a stated percentage change in a variable such as product price. It involves specifying the possible range for the variable, such as price, and calculating the effect of changes in this variable to profitability. With such a calculation, the analyst can determine the relative importance of each of the variables to profitability. However, only risk analysis can provide any indication of the likelihood that such events (change in product price) will actually occur.

Risk analysis takes into account the recognized fact that variables, such as product price, depend on future events whose occurrence can not be predicted with certainty. Hence, investment decision situations can be characterized with respect to certainty, risk and uncertainty. Since certainty seldom exists for future returns on investment, only risk and uncertainty are of interest. Uncertainty is used to refer to an event, such as technological breakthrough resulting in obsolescence, that is expected to take place although the probability of its occurrence cannot be forecasted during the venture's lifetime. Risk refers to a situation in which a probability distribution of future returns cannot be established for the venture. The riskiness of the venture can be defined as the variability or dispersion of its future returns. In practice, there are usually several variables and the aggregate risk of the venture cannot be determined easily because it is composed of numerous risks. The purpose of risk analysis is to isolate the risks and to provide a means by which various venture outcomes can be reduced to a format from which a decision can be made. A more detailed coverage can be found under profitability analysis.

3.3 Feasibility cost estimates

A lot of guess work goes into feasibility cost estimate. Attempts are always made to collect and update historical figures with additions for escalation / inflation and local factors, based on statistics and guess work. In such a situation what is expected is a rule of thumb or an order of magnitude estimate. The order of magnitude estimate is derived from the cost reports of completed ventures. Probability of this estimates accuracy is generally between +25, and 40 percent. Preliminary control estimate is often used in the feasibility report.

This is prepared, generally, after the completion of the process design and major equipment listing. Accuracy of this estimate may vary between + 15 and 25 present. Endeavour is usually made to achieve a +20 present accuracy in the feasibility report estimates. For a rule of thumb, the following are the percentages of the venture cost factors:

-Project development and detailed project report (DPR) preparation - 2 %

-Engineering and design - 13 %

-Brought out materials and equipment-55 %

-Fabrication and construction- 30 %

Depending on the type of venture, sector and complexity, these can vary on either side.

3.4 Break-Even Analysis

Break-even analysis is a technique widely used by production management and management accountants. It is based on categorizing production costs between those which are "variable" (costs that change when the production output changes) and those that are "fixed" (costs not directly related to the volume of production).

Total variable and fixed costs are compared with sales revenue in order to determine the level of sales volume, sales value or production at which the business makes neither a profit nor a loss (the "break-even point").

“A breakeven analysis is used to determine how much sales volume business needs to start making a profit.”

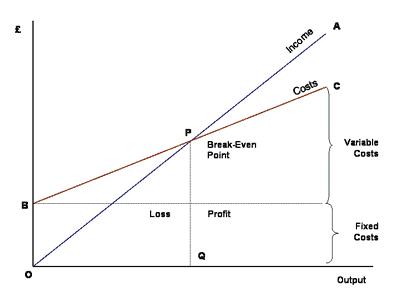

3.4.1 The Break-Even Chart

The break-even chart is a graphical representation of costs at various levels of activity shown on the same chart as the variation of income (or sales, revenue) with the same variation in activity. The point at which neither profit nor loss is made is known as the "break-even point" and is represented on the chart below by the intersection of the two lines:

In the diagram above, the line OA represents the variation of income at varying levels of production activity ("output"). OB represents the total fixed costs in the business. As output increases, variable costs are incurred, meaning that total costs (fixed + variable) also increase. At low levels of output, Costs are greater than Income. At the point of intersection, P, costs are exactly equal to income, and hence neither profit nor loss is made.

3.4.2 Fixed Costs

Fixed costs are those business costs that are not directly related to the level of production or output. In other words, even if the business has a zero output or high output, the level of fixed costs will remain broadly the same. In the long term fixed costs can alter - perhaps as a result of investment in production capacity (e.g. adding a new factory unit) or through the growth in overheads required to support a larger, more complex business.

Examples of fixed costs:

- Rent and rates

- Depreciation

- Research and development

- Marketing costs (non- revenue related)

- Administration costs

3.4.3 Variable Costs

Variable costs are those costs which vary directly with the level of output. They represent payment output-related inputs such as raw materials, direct labour, fuel and revenue-related costs such as commission.

3.4.4 Break Even Point Calculation

Calculation of BEP, per unit of production, can be done using the following formula:

|

BEP |

= |

Total fixed costs |

|

Unit’s selling price – Unit’s variable costs |

For example, suppose that fixed costs for producing 100000 units were

$30,000 a year. Variable costs are $2.20 materials, $4.00 labour, and $0.80 overhead, for a total of $7.00. If selling price was chosen as $12.00 for each units, then: Break even point will be $30,000 divided by ($12.00 - 7.00) equals 6000 units. This is the number of units that have to be sold at a selling price of $12.00 before business will start to make a profit.

3.4.5.1 Advantages and limitation of Break Even Analysis

It explains the relationship between cost, production volume and returns. The major benefit to using break-even analysis is that it indicates the lowest amount of business activity necessary to prevent losses.

However, it is best suited to the analysis of one product at a time