Site pages

Current course

Participants

General

Module- 1. Introduction of food plant design and ...

Module- 2. Location and site selection for food pl...

Module- 3. Food plant size, utilities and services

Module- 4. Food plant layout Introduction, Plannin...

Module- 5. Symbols used for food plant design and ...

Module- 6. Food processing enterprise and engineer...

Module- 7. Process scheduling and operation

Module 8. Building materials and construction

Lesson 12. Engineering economics

12.1 Introduction

Engineering economy is the study of quantitative techniques for the evaluation of engineering alternatives based upon financial criteria.

In production systems engineering, economic choices are required when

phasing-in of new products and services, and phasing-out of existing products and services,

making a choice between alternative production technologies,

choosing plant location and layout, and

when deciding about the questions of equipment replacement etc.

12.2 Important terms of engineering economy

- Time Value of Money: Time value of money is defined as the time dependent value of money stemming both from changes in the purchasing power of money (inflation or deflation) and from the real earning potential of alternative investments over time. The following are reasons why Rs.1000 today is “worth” more than Rs.1000 one year from today. 1. Inflation, 2. Risk, and 3. Cost of money

- Inflation: It is the decrease in the purchasing power of a given sum of money with time due to complex national and international economic factors.

- Interest: It is the money paid for the use of borrowed money. A production concern borrows money from individuals, commercial banks, insurance companies and government, and pays interest on the borrowed money.

- Interest Rate: It is the ratio of the amount of interest paid at the end of a period or time, usually one year, to the sum of money borrowed at the beginning of that period. The sum borrowed is called the Principal. The interest rate is usually expressed as i percent per annum.

- Compound Interest: If a sum of money is borrowed for more than one period of time, then in compound interest, the amount of interest payable at the end of any given period of time is calculated on the total amount payable at the beginning of that period of time. In business, compound interest only is charged.

- Rate of Return: If a production concern invests an amount of money in setting up production facilities, then the ratio of the net profit earned by the company at the end of a period of time to the sum invested is called the Rate of Return on investment.

- Attractive Rate of Return. This is the minimum rate of return which is used as a criterion by which a concern evaluates alternative investment proposals. An alternative whose expected rate of return is less than the attractive rate of return is rejected.

- Payment: Known also as cost, outlay, expenditure or disbursement, payment is any sum paid by a production concern for buying materials, paying wages etc.

- Receipt(s): Known also as return, income, profit or revenue, receipt is any sum received by a production concern from sales of products and services etc.

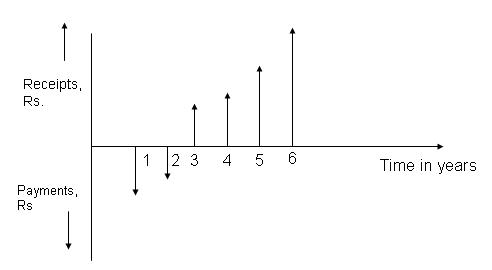

- Cash flow: It is the series of actual or estimated payments and receipts of a production concern over a period of time. The cash flow can be represented in the form of a cash flow diagram as shown in Figure 12.1.

Figure 12.1 A typical Cash-flow diagram - Sunk costs:Engineering economic analysis is concerned with making choices between engineering alternatives. For this purpose all past payments or receipts (called Sunk Costs) 'concerning the alternatives are irrelevant, and are therefore ignored. (sunk = done for)

- Opportunity Costs:If a company invests certain sum of money into a certain venture (or proposal) with an element of risk, that sum is no longer available for investing in any other alternative venture. The profits or returns lost as a result of not investing in a particular alternative is called the Opportunity Cost.

- Asset: An asset of a production concern is a valuable like land, building, machine, material etc.owned by the concern.

- Life of an Asset: The life of an asset can be considered in three ways, (a) Actual or Technological Life of an asset is the duration during which it can fulfil its required functions. It is determined from technological considerations. (b) Accounting Life of an asset is the duration during which the investment made in acquiring the asset is to be recovered from gross profits in the form of depreciation. (c) Economic life of an asset is the duration during which an asset performs its technological function economically. The asset is actually used by the production concern during its economic life only.

- Depreciation: A company invests in assets expecting to earn profits by making use of those assets. However, net profits would accrue only after the investment made in acquiring the assets is recovered. Depreciation is systematic procedure of recovering every year a portion of investment made on an asset during its accounting life. Income tax during a year is chargeable only on the net profit obtained by deducting the amount of depreciation from gross profits.

- Book Value of an Asset: At any time during the accounting life of an asset, its book value is equal to its cost price minus the total amount of depreciation charged on it by that time.

- Salvage Value: It is the actual or estimated value of an existing asset at which it can be sold now or at a certain date in the future.

- Retirement: It is the disposal of an existing asset through sales or abandonment as scrap.

- Replacement: It means acquiring a new asset through purchase or lease to perform the same or extended service which had so far been performed by another asset which has been retired.

- Defender and Challenger: When an economic analysis is made to decide whether or not to replace an existing asset with another, the existing asset is referred to as the Defender and the proposed replacement as the Challenger.

Last modified: Friday, 23 August 2013, 10:52 AM