Site pages

Current course

Participants

General

Module 1: Fundamentals of Reservoir and Farm Ponds

Module 2: Basic Design Aspect of Reservoir and Far...

Module 3: Seepage and Stability Analysis of Reserv...

Module 4: Construction of Reservoir and Farm Ponds

Module 5: Economic Analysis of Farm Pond and Reser...

Module 6: Miscellaneous Aspects on Reservoir and F...

Lesson 27 Introduction to Economic Analysis

27.1 Introduction

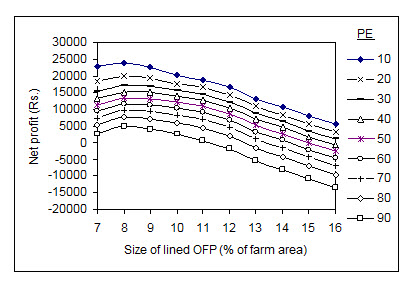

Economic analysis is the most important parameter for determining the optimum size of farm pond. It is no doubt that a big size farm pond can meet the irrigation demand of the crops grown in the command areas in addition to meeting the other water needs during puddling of rice and before sowing of the winter crops. Obviously, an oversized farm pond is likely to incur a large investment which makes the project economically infeasible. On the other hand, a small size pond may not have enough water in it to meet the crop water demand as well as other demands in the command area. Thus, it is adjudged as an under-designed structure. It is observed that the total investment in a farm pond increases gradually with increase in the size of the pond. With increase in the size of the pond, the storage capacity of it increases with simultaneous decrease in the crop area. From economic point of view, initially the increase in the size of the farm pond would increase the benefit/profit from the land and the profit is expected to maximize at a particular size of the pond. If we go for farm pond beyond this size, the profit would decline gradually and at a certain stage it becomes negative as compared to the investment. The graph of net profit with size of the farm pond starts from a minimum and gradually rises to attain a peak and then declines (Fig. 27.1). The size of the farm pond corresponding to the peak of net profit represents the optimum size of the pond. It is so because of reduction in production due to decrease in crop area. The most economical size of the pond is decided based on the highest rate of return on investment. This particular size of the farm pond at which the net profit is maximum, is called as the optimum size. It is to be noted that most of the economic indicators like net profit, benefit-cost ratio and internal rate of return remain high for the optimum size of the farm pond, and payback period lies at its minimum.

Deriving the optimum size of farm pond starts with economic analysis of any assumed minimum size farm pond, say, 5 per cent of the farm area. Economic analysis should include both the cost involved in the pond and the net profit obtained due to application of supplemental irrigation each year. Thus, the analysis continues for the entire life span of the pond.

Fig. 27.1. Net profit from various sizes of lined OFP at different probability of exceedance. PE = probability of exceedance (Source: Sahoo, 2010)

Total sum of net profit at the end of the life span is compared with the total investment for drawing a conclusion pertaining to the economic viability of the project. Thus, the net profit of all higher sizes of the OFP above the assumed minimum size is analyzed and the size that gives the highest net profit is considered as the optimum size of the pond. It is to be noted that any other size, larger or smaller, than the optimum size would give less net profit and in some cases it may be negative also.

Present worth analysis has been recommended by many researchers to determine the optimum size of the farm pond in rainfed areas. In any economic analysis, all cash flows must be evaluated with respect to some reference time. In present worth analysis, all the cash flows (inflows and outflows) over the life span of the project are converted into an equivalent present value at the beginning using appropriate factors to account for interest and inflation. An economic analysis is often associated with preparing a balance sheet of fixed and variable costs in a system against the amount of return. While the fixed cost consists of the initial one time investment in the system, the variable cost includes the parameters those demand investment every year or at some recurrence interval during the life span of the project.

27.2 Initial Investment

Initial investment of OFP irrigation system, also called as fixed cost, includes the following components:

Construction cost of the pond.

Lining cost of the pond if lining is required and

Labour cost of lining (for lined pond).

Construction cost of ponds is estimated taking the volume of earth work into account. For a particular size of the pond with assumed depth and side slope, the dimensions of farm pond are computed as discussed in chapter --. Then the volume of the storage in the pond is computed using the prismoidal formula which gives the volume of earth work required. It is to be remembered that for same volume of earth work excavation, a pond having higher depth would require more cost of excavation than the pond with lower depth. This is because of the difficulty involved in excavating deeper soil profiles than shallower ones. Consequently, more labour force is engaged in digging and then lifting of the soil material from a deeper pond. Similarly, the cost of excavation also depends on the type of soil. If the soil of the pond site is soft, then digging becomes easier and the cost of excavation is less. On the other hand, if the soil is hard and rocky surface is encountered, then excavation cost increases. The lining cost of the pond depends on the extent of area to be lined and the type of the lining materials. The prevailing rate of lining materials, their durability are to be taken into consideration while deciding the lining cost. Cost of brick masonry and polythene lining is more than the ordinary soil-cement or clay lining. The total labour cost/wages for lining the ponds again varies with the extent of area to be lined and the type of lining. Labour wage as per schedule of rates of the state or locality should be taken into consideration while preparing the estimate of the OFP irrigation system.

27.3 Variable Cost

Variable cost also called as annual operating cost includes the following costs:

Pond maintenance cost

Land lease cost

Irrigation cost to meet the irrigation supply from the pond to the crops

Cost of production of the crops under the command area of the pond.

Maintenance cost is used for annual repair and maintenance of the farm pond and its ancillary structures. De-silting of the farm pond; repair and maintenance of the spillways and embankments come under this category. Pond maintenance cost depends on the years of service of the pond, the operating environment and the quality of maintenance. In addition, there are substantial variations in the prices of the input materials and wages of the skilled personnel in maintenance. Annual maintenance cost should therefore be based on local data wherever and whenever possible. When the local data are not available then the annual maintenance cost of farm pond irrigation system can be assumed to be 2% of fixed cost of pond, as a rule of thumb. As the amount of initial investment varies with the pond sizes so, the maintenance cost is likely to vary as the pond size changes.

An on-farm pond, as the term dictates, means a pond in the farm or crop field. The farmer is used to grow crops in the same location before construction of the pond. Had this piece of land not diverted for OFP, it would have been used for growing crops. Thus, due to construction of the pond in the farm itself, the farmer is likely to get less production leading to decline in the net profit. It is similar to a situation when the farmer leases the land for some other purpose to someone else. In this case, the farmer charges the land lease cost on the leasee. The same principle applies here when a portion of the crop field is diverted for the OFP. The land lease cost is considered to have an unbiased economic analysis of the pond irrigation system. The existing lease rate of the land fixed by the Revenue Department of that locality is taken into consideration. This cost varies with the land type based on its utility. For example, the lease cost of a crop land is less than that of a homestead land.

Irrigation cost depends on the method of irrigation and volume of water to be supplied to the crop field. When pumps are used for lifting water from the OFP, the irrigation cost is the pumping cost which includes the cost of energy and the conveying pipes. When drip and sprinkler systems are required for supplying irrigation water to the crops, the cost of the operating systems must be included in the irrigation cost. For various pond sizes, application of supplemental irrigation to crops grown in the command areas of the farm pond will be different and hence, irrigation cost will also be different.

The cost of production depends on the type and acreage of the crops in the command area of the pond. It also varies from region to region. Hence, the production cost of the crops prevailing in the locality must be considered. Production cost includes the cost of (i) agricultural inputs and (ii) field operations. While the inputs to the field are the seeds, fertilizers and pesticides etc., field operations include the (i) land preparation (ii) sowing/planting (iii) intercultural operation (iv) application of fertilizer and pesticide and (v) harvesting.

27.4 Annual Returns from Irrigation

It is obvious that crop yield show a positive response to the enhanced soil moisture effected due to the supplemental irrigation from the farm pond. Annual returns are the values of the increased yields of the crops due to supplemental irrigation. It is calculated by considering the minimum support price (MSP) of the grains/seeds and local market price of the by-products of the crops. When the returns from the pond through pisciculture and its embankment through growing creepers and other crops are taken into account, the annual return is converted to total annual returns. With increase in size of the farm pond, the amount of water available for supplemental irrigation to crops will increase leading to adequate soil moisture condition in the root-zone during the critical growth stages of the crops and obviously, better crop yield as discussed in Section 10.4. The increased yield from the increased size of farm pond is likely to fetch higher total annual returns from the land. Total annual return from a field with OFP irrigation is compared with that from a same size field under complete rainfed condition, the difference between them results in net annual return from the land.

27.5 Present worth Analysis

Present worth (PW) of a project is its fiscal value calculated in the beginning of the project. Present worth analysis is used to evaluate all the cash flows in order to account for the interest and inflation factor in investment. Cash flow in OFP irrigation system is divided into (a) cash inflow; and (b) cash outflow. The cash inflow includes total annual returns from irrigation and cash outflow includes initial investment and variable costs in the system. Annual cash inflows and outflows throughout the life period of the project are converted to their present worth using interest and inflation rate prevailing in the beginning of the project.

Cash Outflow

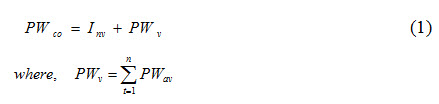

Present worth of cash outflow is computed taking into account the initial investment and the present worth of total variable cost.

Where, PWco= present worth of cash outflow, Rs; Inv = initial investment, Rs; and PWv = present worth of total variable cost, Rs; PWav = present worth of annual variable cost, Rs.; and t = index for the year; and n = life span of the project.

Since, the initial investment is made at the beginning of the project so, the present worth of initial investment is equal to the initial investment itself. Annual variable costs likely to be incurred each year during the life span of the project are converted to their present worth values and are assumed to flow in the beginning of the project.

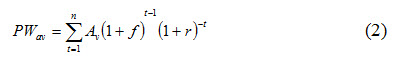

Where, Av = annual variable cost, Rs; f = inflation rate, per cent; and r = interest rate, per cent.

In the economic analysis, the inflation rate or annual rate of cost of escalation should be the average over several years since it varies from year to year and also from country to country. Similarly, when the capital for the project is borrowed from the lending agencies/banks, they do so by levying some interest rate on the borrowed amount. However, this interest rate varies with the purpose for which the capital is used. While for agricultural purpose it is less, for construction of buildings and installation of industries it is more. Again, the rate of interest is not fixed for the entire life span of the project rather it varies from time to time. Hence, an average interest rate over the whole analysis period is used as the rate of interest in present worth analysis. Economic analysis of on-farm pond irrigation systems extends throughout the life span of pond which ranges from 20 to 30 years.

Cash Inflow

Value of all cash inflows each year into the OFP irrigation system is converted to their present values in the beginning of the project taking into account the inflation rate and rate of interest. Cash inflow starts at the end of the year after harvesting of the crops. The produces such as grains/seeds and by-products due to supplemental irrigation from irrigated fields are separately calculated taking their minimum support prices and local market prices into account. The present worth of annual returns is also called the present worth of cash inflow and is expressed as:

Where, PWci = Present worth of cash inflow, Rs. Aar = annual return from the OFP irrigation system, Rs.

Keywords: Earth work, Present worth, Cost, Benefit

References

Sahoo, B.C. (2010). Optimal sizing of On-farm Pond for various crop substitution ratios in rainfed uplands. Unpublished Ph.D. thesis submitted to IIT, Kharagpur.