Site pages

Current course

Participants

General

Module 3. Marketing Management

Lesson 13. Product Pricing and Pricing Strategies

13.1 INTRODUCTION

There is fierce competition and fast-changing environment in the business. Cutting prices is not always the best answer to fight the competition. Reducing prices unnecessarily may lead to loss of profits. It may even signal to customers that the price is more important than the value.

Price in the narrowest sense can be defined as the amount of money charged for a product or service. However, in broader terms, it is the sum of all the values that customers give up in order to gain the benefits of having or using a product or services.

13.2 FACTORS TO BE CONSIDERED WHILE SETTING PRICES

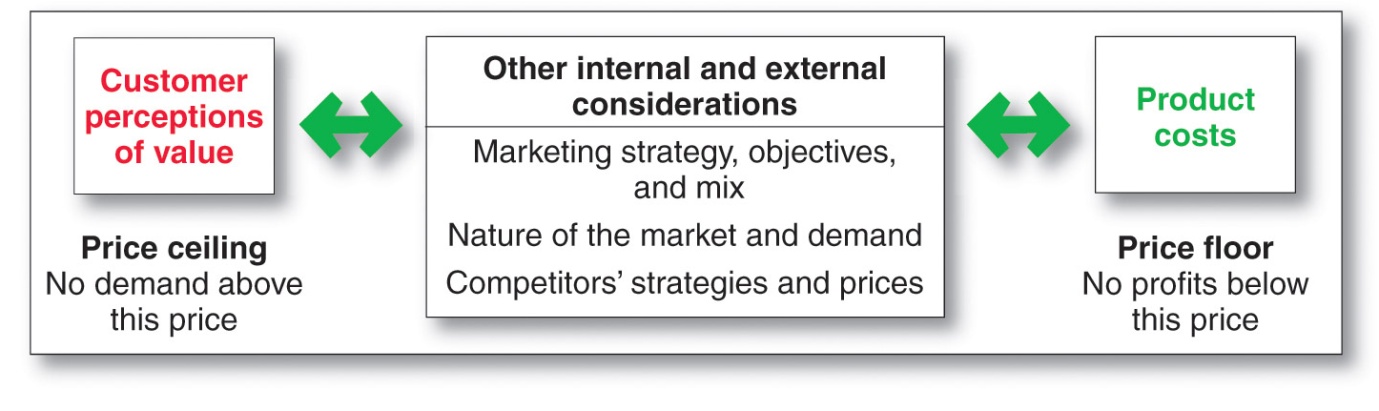

The price charged by the company falls between that is too high to produce any demand and one that is too low to produce profit. Therefore, production cost sets the floor price and products value perceived by the consumer sets the upper limit. The following figure summarizes the factors responsible for setting products price.

Source: Philip Kotler, Principles of Marketing

-

Customer Perception of Value: Good pricing begins with a complete understanding of the value that a product or service creates for customers. If the price set for the product is more than the consumer’s perceived value, then the product will not be sold in the market. Therefore, the price of the product should be less than or equal to the consumer’s perceived value of the product. Thus it sets the upper limit for the price. Considering this factor, the value based pricing approach is designed. According to this approach the marketer cannot design a product & marketing program & then set a price. Price is considered along with the other marketing mix variables before marketing program.

-

Production Costs: Production costs sets the lower limit for the price in the long run. If a product is priced below its production costs, the firm will incur loss and thus may close down in the long run. The cost based pricing approach considers this factor. It involves setting prices based on the costs of producing, distributing and selling the product plus a fair rate of return for effort and risk.

-

Other internal and external considerations:

Overall marketing strategy, objectives, and mix:

Price is only one element of the company’s broader marketing strategy. If the company has selected its target market & positioning carefully, then its marketing strategy will be straightforward.

Price depends on the objective company wants to achieve. It may be survival, profit maximisation, market share leadership, customer retention & relationship building

Price decision must be coordinated with product design, distribution, and promotion decisions to form consistent & effective integrated marketing programmes.

Organisation considerations: The price also depends on the person in the organisation who decides the price.

The market & demand: Before setting the price, pricing decision should obviously consider the expected demand for the product. This price demand relationship differs for different types of market.

- Pricing in different types of markets

Pure competition: This is type of market where there exist many sellers and many buyers. No single buyer or seller can influence the prevailing market prices. Therefore the pricing decision here should be just as per the prevailing market.

Monopolistic competition: The market consists of many buyers and many sellers with differentiated product trade over range of prices. Physical product is differentiated through quality, features, style, service etc.

Oligopolistic competition: Market consists of few sellers who are highly sensitive to each other’s pricing and marketing strategies. If a steel company slashes its prices, buyers will switch to this product. Therefore, other companies have to reduce their prices.

Pure monopoly: The market consists of one seller and many buyers. Seller may be government monopoly, private regulated monopoly of a private non regulated monopoly. Pricing is handled differently in each case. In regulated monopoly, government permits the company to set prices that yield fair return. Non- regulated monopolies are free to set prices at what market will bear.

- Analysing price demand relationship: This relationship is shown by demand curve. A curve that shows the number of units the market will buy in a given time period, at different prices that might be changed. In normal case the price demand are inversely related. Thus company would sell less if it raised its price. However, in case of prestige goods, demand curve slopes upward. Consumers think higher price means higher quality.

- Price elasticity of demand: A measure of the sensitivity of demand to changes in price. If the demand is elastic, the seller will consider lowering their prices. A lower price will yield more total revenue.

4. Competitor’s strategy and prices: In setting prices, company must also consider competitor’s costs, prices and market offerings.

5. Other external factors: Economic condition of the nation, government, social concerns etc.

13.3 NEW PRODUCT PRICING STRATEGIES

- Market skimming pricing: Setting a high price for a new product to skim maximum revenues layer by layer from the segments willing to pay high price. Here, company makes fewer but more profitable sales. The examples are HDTV, Blackberry cell phones. For this strategy to be successful, the product must satisfy the following conditions.

- Product quality and image must support high price

- There must be enough buyers for the product

- Cost of producing small volumes must not be high

- Competitors should not enter market easily and undercut the high price

- Market penetration pricing: Low initial price to penetrate market quickly and deeply. To achieve success in this strategy, following conditions should prevail.

- Market must be highly price sensitive.

- Production and distribution cost must fall as sales volume increases

- Low price must keep competitors away.

13.4 PRODUCT MIX PRICING STRATEGIES

The strategy for setting a product’s price is often changed when the product is part of a product mix. In this case, the firm looks for a set of prices that maximises the profits on the total product mix. Pricing is difficult because the various products have related demand and costs and face different degrees of competition.

There are mainly five product mix pricing strategies

Product line pricing: Companies usually develop product lines rather than single product. In product line pricing, management must decide on the price steps to set between the various products in a line. The price steps should take in to account cost differences between the products in the line, customer evaluations of their different features and competitors’ prices.

Optional-product pricing: The pricing of optional or accessory products along with a main product.

Captive-product pricing: Companies that make products that must be used along with a main product are using captive-product pricing. This is setting a price for products that must be used along with a main product, such as printer cartridges with printers. HP makes very low margin on its printers but very high margins on printer cartridges.

By-product pricing: Setting a price for by-products in order to make the main product’s price more competitive. In producing meats, petroleum and agricultural products, there are often by-products. If the by-products have no value and if getting rid of them is costly, this will affect the pricing of the main product. Using by-product pricing, the manufacturer will seek a market for these by-products and should accept any price that covers more than the cost of storing and delivering them.

Product bundle pricing: Combining several products and offering the bundle at a reduced price. For example, fast-food restaurants bundle a burger, fries and a soft drink at a combo price.

13.5 PRICE ADJUSTMENT STRATEGIES

Companies usually adjust their price to account for various customer differences and changing situations. Seven price adjustment strategies are briefly discussed below.

Discount and Allowance Pricing: Most of the companies adjust their basic price to reward customers for certain responses such as early payment of bills, volume purchases and off-season buying. These price adjustments are called discounts and allowances. Discount means a straight reduction in price on purchases during a stated period of time. Allowances are another type of reduction from the list price. For example, trade-in allowances are price reductions given for turning in an old item when buying a new one. This is followed with many durable goods.

Segmented Pricing: Companies will often adjust their prices to allow for difference in customers, products, and locations. In segmented pricing, the company sells a product or service at two or more prices, even though the differences in prices are not based on differences in costs.

Psychological Pricing: A pricing approach that considers the psychology of prices and not simply economics; the price is used to say something about the product. For example, consumers usually perceive higher priced products as having higher quality. Another aspect of psychological pricing is reference pricing. For example, the fact that a product is sold in a prestigious department store might signal that it’s worth higher price.

Promotional Pricing: Temporarily pricing products below the list price, and sometimes even below cost, to increase short-run sales.

Geographical Pricing: Setting prices for customers located in different parts of the country or world. A company also must decide how to price its products for customers located in different parts of the country or world. Should the company risk losing the business of more-distant customers by charging them higher prices to cover the higher shipping costs? Or should the company charge all customers the same prices regardless of location? The pricing strategy which considers these aspects geographical pricing.

Dynamic Pricing: Adjusting prices continually to meet the characteristics and needs of individual customers and situations.

International Pricing: Companies that market their products internationally must decide what prices to charge in the different countries in which they operate. The price that a company should charge in a specific country depends on many factors, including economic conditions, competitive situations, laws and regulations, and development of wholesaling and retailing systems.