Site pages

Current course

Participants

General

Module 4. Concepts and application of management p...

Lesson-20 Strategic Management in Agribusiness

18.1 INTRODUCTION

Strategic management is the set of managerial decision and action that determines the long-run performance of a corporation. It includes environmental scanning (both external and internal), strategy formulation (strategic or long range planning), strategy implementation, and evaluation and control. The study of strategic management therefore emphasizes the monitoring and evaluating of external opportunities and threats in lights of a corporation’s strengths and weaknesses. Today’s business news is filled with reports of organizations making changes in their strategies for whatever reasons. An underlying theme of discussing strategic management is that good strategies can lead to high organizational performance.

20.2 THE IMPORTANCE OF STRATEGIC MANAGEMENT

Strategic management is a process through which managers formulate and implement strategies geared to optimizing goal achievement, given available environmental and internal conditions. Strategic management is that set of managerial decisions and actions that determines the long-run performance of an organization. It entails all of the basic management functions—planning, organizing, leading, and controlling.

The strategic management process is made up of several components.

1. Strategy formulation is the part of the strategic management process that includes.

a. Identifying the mission and strategic goals.

b. Conducting competitive analysis

c. Developing specific strategies

2. Strategy implementation is the part of the strategic management process that focuses on.

a. Carrying strategic plans.

b. Maintaining control over how those plans are carried out.

20.3 ENVIRONMENTAL SCANNING AND INDUSTRY ANALYSIS

Environmental scanning is the monitoring, evaluating and disseminating of information from the external and internal environments to keep people within the corporation. It is a tool that a corporation uses to avoid strategic surprise and to ensure long-term health.

Scanning of external environmental variables: The external environment include general forces that do not directly touch on the short-run activities of the organization but those can, and often do, influence its long-run decisions. These forces are economic forces, technological forces, political-legal forces and socio-cultural forces

20.4 MICHAEL PORTER’S APPROACH TO INDUSTRY ANALYSIS

Michael Porter, an authority on competitive strategy, contends that a corporation is most concerned with the intensity of competition within its industry. Basic competitive forces determine the intensity level. The stronger each of these forces is, the more companies are limited in their ability to raise prices and earned greater profits.

Threat of new entrants

New entrants are newcomers to an existing industry. They typically bring new capacity, a desire to gain market share and substantial resources. Therefore they are threats to an established corporation. Some of the possible barriers to entry are the following.

1. Economies of scale

2. Product differentiation

3. Capital requirements

4. Switching costs

5. Access to distribution channels

6. Cost disadvantages independent of size

7. Government policy

Rivalry among existing firms

Rivalry is the amount of direct competition in an industry. In most industries corporations are mutually dependent. A competitive move by one firm can be expected to have a noticeable effect on its competitors and thus make us retaliation or counter efforts. According to Porter, intense rivalry is related to the presence of the following factors.

1. Number of competitors

2. Rate of industry growth

3. Product or service characteristics

4. Amount of fixed costs

5. Capacity

6. Height of exit barriers

7. Diversity of rivals

Threat of substitute product or services

Substitute products are those products that appear to be different but can satisfy the same need as another product. According to Porter, “Substitute limit the potential returns of an industry by placing a ceiling on the prices firms in the industry can profitably charge.” To the extent that switching costs are low, substitutes may have a strong effect on the industry.

Bargaining power of buyers

Buyers affect the industry through their ability to force down prices, bargain for higher quality or more services, and play competitors against each other.

Bargaining power of supplier

Suppliers can affect the industry through their ability to raise prices or reduce the quality of purchased goods and services.

20.5 SWOT ANALYSIS

The SWOT analysis involves assessing organization strengths (S) and weaknesses (W), as well as environmental opportunities (O) and threats (T).

1. Strengths and weaknesses apply to internal characteristics.

a. A strength is an internal characteristic that has the potential of improving the organization’s competitive situation.

b. A weakness is an internal characteristic that leaves the organization potentially vulnerable to strategic moves by competitors.

2. Opportunities and threats are found in the external environment.

a. An opportunity is an environmental condition that offers significant prospects for improving an organization’s situation relative to competitors.

b. A threat is an environmental condition that offers significant prospects for undermining an organization’s competitive situation.

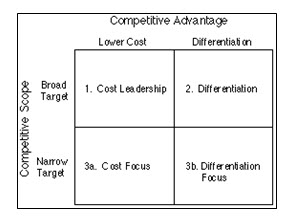

20.6 PORTER'S GENERIC COMPETITIVE STRATEGIES

A firm's relative position within its industry determines whether a firm's profitability is above or below the industry average. The fundamental basis of above average profitability in the long run is sustainable competitive advantage. There are two basic types of competitive advantage a firm can possess: low cost or differentiation. The two basic types of competitive advantage combined with the scope of activities for which a firm seeks to achieve them, lead to three generic strategies for achieving above average performance in an industry: cost leadership, differentiation, and focus. The focus strategy has two variants, cost focus and differentiation focus.

1. Cost Leadership

In cost leadership, a firm sets out to become the low cost producer in its industry. The sources of cost advantage are varied and depend on the structure of the industry. They may include the pursuit of economies of scale, proprietary technology, preferential access to raw materials and other factors. A low cost producer must find and exploit all sources of cost advantage. if a firm can achieve and sustain overall cost leadership, then it will be an above average performer in its industry, provided it can command prices at or near the industry average.

2. Differentiation

In a differentiation strategy a firm seeks to be unique in its industry along some dimensions that are widely valued by buyers. It selects one or more attributes that many buyers in an industry perceive as important, and uniquely positions itself to meet those needs. It is rewarded for its uniqueness with a premium price.

3. Focus

The generic strategy of focus rests on the choice of a narrow competitive scope within an industry. The focuser selects a segment or group of segments in the industry and tailors its strategy to serving them to the exclusion of others. The focus strategy has two variants.

(a) In cost focus a firm seeks a cost advantage in its target segment, while in

(b) Differentiation focus a firm seeks differentiation in its target segment. Both variants of the focus strategy rest on differences between a focuser's target segment and other segments in the industry. The target segments must either have buyers with unusual needs or else the production and delivery system that best serves the target segment must differ from that of other industry segments. Cost focus exploits differences in cost behaviour in some segments, while differentiation focus exploits the special needs of buyers in certain segments.

20.7 LEVEL OF STRATEGIES

Many organizations develop strategies at three different levels. These three different and distinct levels of strategy are corporate, business, and functional: The corporate level strategy is discussed in detail below.

Corporate-level strategy is developed by top-level management and the board of directors. The corporate-level strategy seeks to determine what businesses a corporation should be in or wants to be in.

20.7.1 FORMULATING CORPORATE-LEVEL STRATEGY

A. A grand strategy (master strategy) provides the basic strategic direction at the corporate level of the organization. Four grand strategies have been identified.

1. Growth strategies are grand strategies that involve organizational expansion along some major dimension.

a. Concentration focuses on effecting the growth of a single product or service or a small number of closely related products or services.

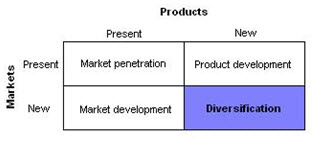

Ansoff Growth Matrix is very important strategy in business industry. Any company can measure how achieve their market in this strategy. It consists of four kinds of strategies depending on products and markets. There are

a) Market penetration: existing products and existing markets

b) Product development: new products and existing markets

c) Market development: new markets and existing products

d) Diversification: new markets and new products.

1) Market development is gaining a larger share of a current market or expanding into new ones.

2) Product development is improving a basic product or service or expanding into closely related products or services.

3) a. Horizontal integration is adding one or more business that is similar, usually by purchasing such business.

b. Vertical integration involves effecting growth through the production of inputs previously provided by suppliers or through the replacement of a customer role (Such as that of a distributor) by disposing of one’s own outputs.

1) Backward integration occurs when a business grows by becoming its own supplier

2) Forward integration occurs when organizational growth encompasses a role previously fulfilled by a customer.

3) Diversification entails effecting growth through the development of new areas that are clearly distinct from current businesses.

i. Conglomerate diversification takes place when an organization diversifies into areas that are unrelated to its current business.

ii. Concentric diversification occurs when an organization diversifies into a related, but distinct, business.

These growth strategies can be implemented through a number of means:

1) Internal growth occurs as the organization expands by building on its own internal resources.

2) An acquisition is the purchase of all or part of one organization by another.

3) A merger is the combining of two or more companies into one organization.

4) A joint venture occurs when two or more organizations provide resources to support a given project or product offering.

2. A stability strategy is a second type of grand strategy that involves maintaining the status quo or growing in a methodical, but slow, manner.

a. Small, privately owned businesses are most likely to adopt this strategy.

b. Some of the reasons for adopting a stability strategy are that it

1) Avoids the risks or hassles of aggressive growth.

2) Provides the opportunity to recover after a period of accelerated growth.

3) Lets the company hold on to current market share.

4) May occur through default.

3. Defensive strategies, the third class of grand strategies, are sometimes called retrenchment strategies. They tend to focus on the desire or need to reduce organizational operations usually through cost reductions, such as cutting back on non-essential expenditures and instituting hiring freezes, and/or asset reductions such as selling land, equipment, or the business itself.

a. Harvest entails minimizing investments while attempting to maximize short-run profits and cash flow, with the long-run intention of existing with the market.

b. A turnaround is designed to reverse a negative trend and restore the organization to appropriate levels of profitability.

c. A divestiture involves an organization’s selling or divesting of a business or part of a business.

d. A bankruptcy is a means whereby an organization that is unable to pay its debts can seek court protection from creditors and from certain contract obligations while it attempts to regain financial stability.

e. Liquidation entails selling or dissolving an entire organization.

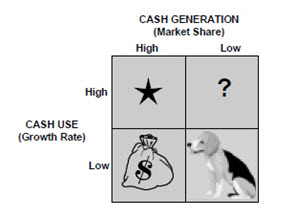

B. A portfolio strategy approach is a method of analyzing an organization’s mix of businesses in terms of both individual and collective contributions to strategic goals. Two portfolio approaches are used most frequently. Each uses a two-dimensional matrix, and each may apply to either the existing or to potential strategic business units (SBUs). The portfolio concept is analogous to an individual’s selecting a portfolio of stocks to achieve balance in terms of risk, long-term growth, etc.

The BCG Matrix method is the most well-known portfolio management tool. It is based on product life cycle theory. It was developed in the early 70s by the Boston Consulting Group. The BCG Matrix can be used to determine what priorities should be given in the product portfolio of a business unit. To ensure long-term value creation, a company should have a portfolio of products that contains both high-growth products in need of cash inputs and low-growth products that generate a lot of cash. The Boston Consulting Group Matrix has 2 dimensions: market share and market growth. The basic idea behind it is: if a product has a bigger market share, or if the product's market grows faster, it is better for the company.

The categories are:

Cash cows are units with high market share in a slow-growing industry. These units typically generate cash in excess of the amount of cash needed to maintain the business. They are regarded as staid and boring, in a "mature" market, and every corporation would be thrilled to own as many as possible. They are to be "milked" continuously with as little investment as possible, since such investment would be wasted in an industry with low growth.

Dogs, more charitably called pets, are units with low market share in a mature, slow-growing industry. These units typically "break even", generating barely enough cash to maintain the business's market share. Though owning a break-even unit provides the social benefit of providing jobs and possible synergies that assist other business units, from an accounting point of view such a unit is worthless, not generating cash for the company. They depress a profitable company's return on assets ratio, used by many investors to judge how well a company is being managed. Dogs, it is thought, should be sold off.

Question marks (also known as problem children) are growing rapidly and thus consume large amounts of cash, but because they have low market shares they do not generate much cash. The result is a large net cash consumption. A question mark has the potential to gain market share and become a star, and eventually a cash cow when the market growth slows. If the question mark does not succeed in becoming the market leader, then after perhaps years of cash consumption it will degenerate into a dog when the market growth declines. Question marks must be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

Stars are units with a high market share in a fast-growing industry. The hope is that stars become the next cash cows. Sustaining the business unit's market leadership may require extra cash, but this is worthwhile if that's what it takes for the unit to remain a leader. When growth slows, if they have been able to maintain their category leadership stars become cash cows, else they become dogs due to low relative market share.

Suggested Reading:

R. Srinivisan. Strategic Management, The Indian Context. PHI

Mason A. Carpenter, Prashant Salwan, Wm Gerard Sanders. Strategic Management, Concepts & Cases. Pearson Education