Site pages

Current course

Participants

General

MODULE 1. Systems concept

MODULE 2. Requirements for linear programming prob...

MODULE 3. Mathematical formulation of Linear progr...

MODULE 5. Simplex method, degeneracy and duality i...

MODULE 6. Artificial Variable techniques- Big M Me...

MODULE 7.

MODULE 8.

MODULE 9. Cost analysis

MODULE 10. Transporatation problems

MODULE 11. Assignment problems

MODULE 12. waiting line problems

MODULE 13. Network Scheduling by PERT / CPM

MODULE 14. Resource Analysis in Network Scheduling

LESSON 1. Cost Analysis: Cost of Operation / Production

Cost analysis - introduction - capital and sources - interest and present value concepts - cost of operation / production - fixed cost – interest, taxes and insurance, depreciation - variable costs – methods of determination of depreciation - straight line method, declining balance method, sum-of-years digits and straight line method.

1. Introduction

Engineers are often required to make cost analysis and make decisions on use of capital in their operations. These analyses and decisions are concerned with how best to allocate the limited funds available to facilities and equipment so as to achieve the objectives.

In some cases, the capital allocation decisions involve the trade-off between labourers and equipment. Labour costs are usually regarded as operating costs of a variable nature, whereas facilities and equipment are classified as “fixed.” In these sense, the capital allocation decisions have an extended impact on the organization, for the fixed costs are charged off against income over several years in the future.

Cost Analysis: Cost of Operation / Production

2. Capital and Sources

Capital is a resource of funds owned or used by an organization. Owing to its limited availability, the use of funds is usually carefully planned and controlled. A financial plan which shows the sources and allocations of funds for a given period in the future is called a capital budget. An organization may obtain funds from either or both of two major sources.

Equity and debt are considered as the important external sources. Equity capital comes from the funds paid in for capital stock ownership. Debt capital constitutes the funds borrowed through bonds, notes and other liabilities. Internally, an organization may increase its available funds by retaining earnings from profits generated in the past. In profit-making organizations, some profits are typically distributed to stockholders, but those retained earnings not paid out as dividends become available for capital budgeting.

3. Interest and Present Value Concepts

Interest is the cost of money, or the rental rate for funds. This cost is determined by the availability of capital funds in the economy, the alternative opportunities investors enjoy to use those funds, and the risk of loss the lenders must take. Funds used in very safe investments involve little risk of loss and can usually be obtained at a more moderate cost. Funds used in more speculative ventures typically offer a greater potential earning power, but the borrower must compensate the lender for the greater risk of loss by paying a higher rate of interest. Thus the risk, along with economic conditions in general, helps establish a basic interest rate.

Given the interest rate, the total amount of interest charged to a borrower is then proportional to the principal amount borrowed and the length of time until repayment.

Interest = (Principal)× (Rate of interest)× (Time)

I = p i n

where,

I = interest, Rs.

p = principal amount borrowed, Rs.

i = rate of interest, decimals

n = length of time of repayment, years

The total amount due at the end of a time period consists of the principal amount borrowed plus the interest on that principal.

Let,

P = present value amount of the principal

i = interest rate, and

F = future sum due

Thus we have for one time period:

F1 = P + P (i) = P(1 + i)

The total amount due at the end of two time periods consists of the amount due at the end of the first period, P(1 + i), plus interest on that amount for the second period:

F2 = P(1+i)+ P(1+i) i = P(1+ i) (1+i)

F2 = P(1+i)2

Similarly, at the end of three years:

F3 = P(1+i)3

And for n years, the future sum (F) is:

F = P(1+i)n

4. Cost of Operation / Production

The total cost of operation or cost of production is the sum of fixed cost and variable cost. The fixed cost includes those costs which are incurred irrespective of the duration of operation and capacity of production. The following are the expenditures include under the fixed cost.

Interest on the borrowed capital

Interest on the capital invested for land, building, shelter, plant and machinery

Interest on the working capital

Depreciation on the assets

Taxes and insurance

The costs or expenditure incurred that varies with the duration of operation or production level is called the variable cost. Commonly they include,

Salary and wages

Fuel and electricity

Expenditure on repairs, maintenance and spares

Cost of ingredients, packaging materials, etc in case on production

Communication expenditure – like telephone charges, email, fax, etc.

Stationery and printing

4.1. Fixed cost

-

Interest: The actual interest paid for the borrowed capital, capital invested for land, building, shelter, plant and machinery and working capital or the prevailing rate of interest is taken for the calculation purposes.

-

Taxes and insurance: The various taxes paid to the local bodies, like wealth tax, water tax, road tax, employment tax and various deposits remitted are taken on actual basis.

-

Depreciation on the assets : Depreciation is a charge that reflects the decrease in value of an asset over time. Since most fixed assets have a limited useful life, their cost should be charged off gradually against the income they help produce during that useful life. No cash flows out of the organization when this accounting entry is made, but the use of any given asset must be reflected as an expense of doing business

4.2. Depreciation

Depreciation is an expense that must be deduced from the gross operating income of an organization. Depreciation is sometimes referred to as a source of funds, but it is actually no more of a source than are any other funds in the organization.

Depreciation is determined by the following methods.

a. Straight line method

b. Declining balance method

c. Sum-of-years digits

d. Straight line method

4.2.1.Straight line method

Under straight-line depreciation the book value of an asset decreases at a constant rate over the life of the asset. If P represents the original investment value, S represents salvage, and n is the number of years of life, the depreciation is:

Straight-line depreciation,

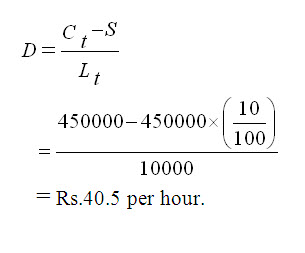

D = (Investment – salvage) / life

= (P –S) / n

This method is very simple and the calculation is direct.

4.2.2. Declining balance method

Under declining-balance depreciation a fixed percentage of the book value of the asset is deducted each period (for example, each year) and the book value decreases at a decreasing rate. This accelerated depreciation method results in a most rapid decline in value in the early stages of an asset’s life. The percentage of depreciation allowed varies from 5 to 25%.

4.2.3. Sum-of-years digits method

Under the sum-of-years digits depreciation, the digits representing each year of life of the asset are summed and this total serves as the denominator of a fraction which is multiplied by the value. The numerator varies each period, beginning with the largest-year digit down to the smallest. Thus for the first year:

Sum-of-years depreciation = n/Σn (I-S)

For the second year, the numerator is n-1

The sum-of-years digits is an accelerated depreciation method and the asset value decreases at a decreasing rate. It does not yield as rapid a depreciation schedule as the declining-balance method, however.

4.3. Example

1. Determine the cost of operation of a 35 hp tractor and cost of ploughing a hectare using a 3 bottom plough of 30 cm width, for the following details.

Cost of the tractor - Rs.4,50,000

Cost of the plough - Rs.15,000

Fuel consumption of tractor - 7 litres per hour

Ploughing speed - 4.5 km per hour.

Make necessary assumptions, wherever required.

Solution:

Assumptions:

Life of tractor , Lt = 10 years (10000 h)

Life of implement, Li = 10 years (3000 h)

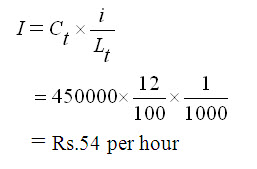

Interest rate, I = 12%

Depreciation, D = 10%

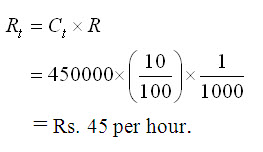

Repair and maintenance, R = 10% of initial cost

Fuel cost , F = 52 per litre of diesel

Lubricants , L = 10% of fuel cost

Wages/Salary for operator, W = Rs.500 per day of 8 h

Housing, tax & insurance, H = 5% of the initial cost per year

Scrap value, S = 10% of initial cost

Cost of tractor, Ct = Rs.4,50,000

Cost of Plough, Cp = Rs.15,0000

Fuel Consumption rate, Fr = 7 l/h

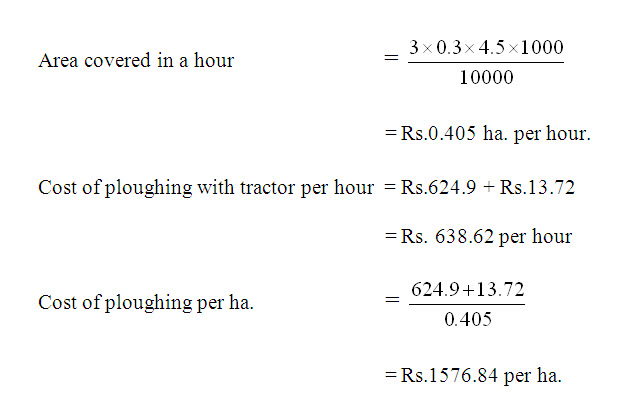

Speed of plugging, v = 4.5 km/h

Width of plough, w = 30 cm = 0.3 m

No. of bottoms, n = 3

- Cost of operation for tractor:

A. Fixed cost

A1. Depreciation:

A2. Interest:

A3. Repairs and maintenance:

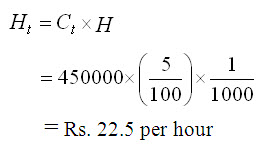

A4. Housing, tax and interest:

A= A1+A2+A3+A4

= 40.5+ 54 + 45 + 22.5

= Rs.162 per hour.

B. Variable Cost

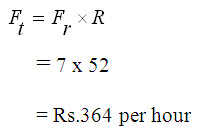

B1. Cost of fuel:

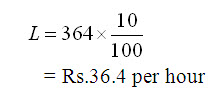

B2. Lubricants cost

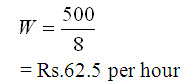

B3. Wages to the operator

Total Variable cost, B = B1 + B2 + B3 = 364 + 36.4 + 62.5 = Rs. 462.9 per hour

Total cost of operation of tractor per hour = A+B

= Rs. 162 + 462.90

= Rs. 624.9 per hour

2. Cost of Ploughing:

A. Fixed Cost

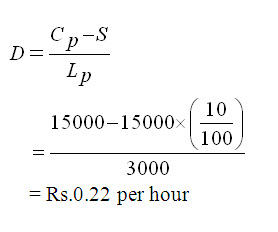

A1.Depreciation:

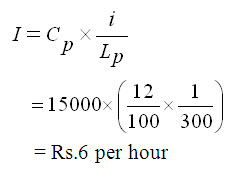

A2. Interest:

A3. Repairs and Maintenance:

A4. Housing and Tax:

Total Fixed Cost, A = A1 + A2 + A3 + A4

= 0.22 + 6 + 5 +2.5

= Rs.13.72 per hour

B. Variable Cost

Since the plough is operated along with the tractor, the variable cost for the tractor will be applicable for the tractor and plough.

Total cost of operating plough per hour = Rs.13.72 per hour