Site pages

Current course

Participants

General

MODULE 1. Systems concept

MODULE 2. Requirements for linear programming prob...

MODULE 3. Mathematical formulation of Linear progr...

MODULE 5. Simplex method, degeneracy and duality i...

MODULE 6. Artificial Variable techniques- Big M Me...

MODULE 7.

MODULE 8.

MODULE 9. Cost analysis

MODULE 10. Transporatation problems

MODULE 11. Assignment problems

MODULE 12. waiting line problems

MODULE 13. Network Scheduling by PERT / CPM

MODULE 14. Resource Analysis in Network Scheduling

LESSON 3. Inventory Control

Cost analysis - inventory control - causes of poor inventory control - types of inventories - direct and indirect - inventory costs - purchase costs, carrying cost, setup costs and shortage costs - inventory model - economic order quantity (EOQ) - inventory control systems - fixed-order quantity system and fixed-order interval system.

1. Introduction

An inventory consists of usable but idle resources such as men, machines, materials or money. When the resources involved is a material, the inventory is called “stock”. Though inventory of materials is an idle resource (since the material lie idle and are not to be used immediately), almost every organisation must maintain it for efficient and smooth running of its operations. Without this no business activity can be performed, whether it is a service organisation like a hospital or a bank or it is a manufacturing or trading organisation. If an enterprise has no inventory of materials at all, on receiving a sales order it will have to place order for purchase of raw materials, wait of their receipt and then start production. This makes the customer to wait for the delivery of the goods and may turn to other suppliers. resulting in loss of business for the enterprise. Most organisations have 20 to 25% of their total funds devoted to inventory. It may even increase to 70% in cause of pharmaceutical, chemical and paints industries.

2. Importance of Maintaining Inventory

Maintaining an inventory is necessary because of the following reasons:

-

It helps in smooth and efficient running of an enterprise by ensuring the availability of the required raw materials and spares.

-

It facilitates to provide service to the customer at a short notice. Timely deliveries / services will fetch more goodwill and orders, besides reputation.

-

In the absence of inventory, the enterprise may have to pay high prices during the purchases made on emergency.

-

Maintaining inventory or bulk purchasing may earn price discount.

-

It reduces production cost since there is an added advantage of batching and long, uninterrupted production runs.

-

It acts as a buffer stock when raw materials are received late and shop rejections are too many.

-

Process and movement inventories (also called pipeline stocks) are quite necessary in big enterprises where significant amounts of times are required to tranship items from one location to another.

-

Bulk purchases will entail less order and, therefore, less administrative costs. This applies to goods produced within the organisation as well. Less order, as a result of larger lots, will entail lesser machine setups and other associated costs.

-

An organisation may have to deal with several customers and vendors who are not necessarily near it. Inventories, therefore, have to be built to meet the demand at least during the transit time.

-

It helps in maintaining economy by absorbing some of the fluctuations when the demand for an item fluctuates or is seasonal.

However, too often inventories are wrongly used as a substitute for management. Also maintenance of inventory costs additional money to be spent on personnel, equipment, insurance, etc. thus excess inventories are not desirable. This necessitates controlling the inventories in the most useful way.

3. Causes of Poor Inventory Control

-

Overbuying without regard to the forecast or proper estimate of demand to take advantage of favourable market.

-

Over production or production of goods much before the customer requires them.

-

Overstocking due to bulk production to reduce production costs will also result in large inventories.

-

Cancellation of orders and minimum quantity stipulations by the suppliers may also give rise to large inventories.

4. Types of Inventories

Inventories are generally classified into the following types:

4.1. Direct inventories

They include items that are directly used for production and are classified as:

-

Production Inventory: items such as raw materials, components and subassemblies used to produce the final product.

-

Work-in-Process Inventory: Items in semi-finished form or products at different stages of production.

-

Finished Goods Inventory: This includes the final products ready for dispatch to consumers or distributors.

-

Maintenance, repair and operating (MRO) Inventory: Maintenance, repair and operating items such as spare parts and consumable stores that do not go into the final product but are consumed during the production process.

-

Miscellaneous Inventory: All other items such as scrap, obsolete and unsalable products, stationery and other items used in office, factory and sales department, etc.

4.2. Indirect inventories

Indirect inventories are those directly or indirectly used in the production. They may be in transit, stored for future use, etc. They may be classified as:

-

Transit or Pipeline Inventories: Also called movement inventories, they consist of items that are currently under transportation e.g., coal being transported from coalfields to a thermal plant.

-

Buffer Inventories: They are required as protection against the uncertainties of supply and demand. A company may well know the average demand of an item that it needs; average value. Similarly, the average delivery period (lead time) may be known but due to some unforeseen reasons, the actual delivery period could be much more. Such situations require extra stock in excess of the average demand during the lead time is called buffer stock (or safety stock or custom stock).

-

Decoupling Inventories: They are required to decouple or disengage the different parts of the production system. For an item that requires processing on a series of different machines with different processing times, it is a must to have decoupling inventories of the item in between the various machines for smooth and continuous production. The decoupling inventories act as shock absorbers in case of varying work-rates, machines breakdowns or failures, etc.

-

Seasonal Inventories: Some items have seasonal demands e.g., demand of woolen textiles in winter, coolers and air conditioners in summer, raincoats in rainy season, etc. inventories for such items have to be maintained to meet their high seasonal demand.

-

Lot Size Inventories: Items are usually purchased in lots to

-

avail price discounts

-

reduce transportation and purchase costs

-

minimize handling and receiving costs.

Lot size or cycle inventories are, therefore, held by purchasing items in lots rather than their exact quantities required. For example, a textile industry may buy cotton in bulk during cotton season rather than buying it everyday.

6. Anticipation Inventories: They are held to meet the anticipated demand. Purchasing of crackers well before Diwali, fans before the approaching summer, piling up of raw material in the face of imminent transporters strike are examples of anticipation inventories.

5. Inventory Costs

The four costs considered in inventory control models are:

-

Purchase costs

-

Inventory carrying or stock holding costs

-

Procurement costs (for bought-outs) or setup costs (for made-ins) and

-

Shortage costs (due to disservice to the customers).

5.1. Purchase costs

It is the price that is paid for purchasing / producing an item. It may be constant per unit or may vary with the quantity purchased / produced. If the cost per unit is constant, it does not affect the inventory control decision. However, the purchase cost is definitely considered when it varies as in quantity discount situations.

5.2. Inventory carrying costs (or stock holding costs or holding costs or storage costs)

They arise on account of maintaining the stocks and the interest paid on the capital tied up with the stocks. They vary directly with the size of the inventory as well as the time for which the item is held in stock. Various components of the stockholding cost are:

1. Cost of money or capital tied up in inventories: This is, by far, the most important component. Money borrowed from the banks may cost interest of about 12%. But usually the problem is viewed in a slightly different way i.e., how much the organisation would have earned, had the capital been invested in an alternative project such as developing new product, etc. it is generally taken somewhere around 15% to 20% of the value of the inventories.

2. Cost of storage space: This consists of rent for space. Besides space expenses, this will also include heating, lighting and other atmospheric control expenses. Typical values may vary from 1 to 3%.

3. Depreciation and deterioration costs: They are especially important for fashion items or items undergoing chemical changes during storage. Fragile items such as crockery are liable to damage, breakage, etc. 0.2% to 1% of the stock value may be lost due to damage and deterioration.

4. Pilferage cost: It depends upon the nature of the item. Valuables such as gun metal bushes and expensive tools may be more tempting, while there is hardly any possibility of heavy casting for forging being stolen. While the former must be kept under lock and key, the latter may be simply dumped in the stockyard. Pilferage cost may be taken as 1% of the stock value.

5. Obsolescence cost: It depends upon the nature of the item in stock. Electronic and computer components are likely to be fast outdated. Changes in design also lead to obsolescence. It may be possible to quantify the percentage loss due to obsolescence and it may be taken as 5% of the stock value.

6. Handling costs: These include all costs associated with movement of stock, such as cost of labour, overhead cranes and other machinery used for this purpose.

7. Record – keeping and administrative cost: There is no use of keeping stocks unless one can easily know whether or not the required item is in stock. This signifies the need of keeping funds for record-keeping and necessary administration.

8. Taxes and Insurance. Most organisations have insurance cover against possible loss from theft, fire, etc. and this may cost 1% to 2% of the invested capital.

Inventory carrying cost C1 is expressed either as per cent of the value or per unit time (e.g., 20% of the value of the stock per year) or in terms of monetary value/unit/unit time (e.g., Rs. 5/unit/year).

Example: If the average stock during a year is of value Rs. 20,000, the inventory carrying costs, being, say, equal to 20%, amount to Rs. 20,000 x (20/100) = Rs. 4,000.

5.3. Procurement costs or set-up costs or ordering cost

These include the fixed cost associated with placing of an order or setting up a machinery before starting production. They include costs of purchase, requisition, follow up, receiving the goods, quality control, cost of mailing, telephone calls and other follow up actions, salaries of persons for accounting and auditing, etc. also called ordering costs or replenishment costs, they are assumed to be independent of the quantity ordered or produced but directly proportional to the number or orders placed. At times, however, these costs may not bear any simple relationship to the number of orders. More than one stock item may be ordered on one set of the documents; the clerical staff is not divisible and without the existing staff increasing or decreasing, there may be considerable scope for changing the number of orders. In such a case, the acquisition cost relationship may be quadratic or stepped instead of a straight line. They are expressed in terms of Rs. per order or Rs. per set-up.

5.4. Shortage costs or stock-out costs

These costs are associated with either a delay in meeting demands or the inability to meet it at all. Therefore, shortage costs are usually interpreted in two ways. In case the unfilled demand can be filled at a later stage (backlog case), these costs are proportional to quantity that is short as well as the delay time and are expressed as Rs. per unit back ordered per unit time (e.g. Rs.7/unit/year). They represent loss of goodwill and cost of idle equipment. In case the unfilled demand is lost (no backlog case), these costs become proportional to only the quantity that is short. This results in cancelled orders, lost sales, profit and even the business itself.

It follows from the above discussion that if the purchase cost is constant and independent of the quantity purchased, it is not considered in formulating the inventory control policy. The total variable inventory cost in this case is given by

Total variable inventory cost = Carrying cost + Ordering cost + Shortage cost.

However, if the unit cost depends upon the quantity purchased i.e., price discounts are available, the purchase cost is definitely considered in formulating the inventory control policy. The total variable inventory cost in this case is then given by

Total variable inventory cost = Purchase cost + Carrying cost + Ordering cost + Shortage cost.

6. Inventory Model for Economic Order Quantity (EOQ)

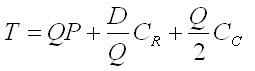

The total cost of the inventory is the sum of carrying cost, ordering cost and purchase cost.

Let,

T total cost of the inventory

D demand in units per annum

CR ordering cost per order

Cc carrying cost per unit for the given period or a percentage of the unit cost

P purchase cost per unit

Q order lot size, units

Q/2 the average inventory over a given period, when the inventory varies from 0 to Q

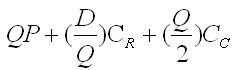

Total cost, T = (1)

(1)

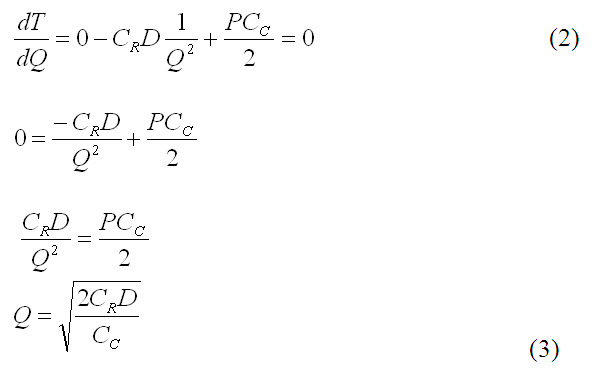

Differentiating with respect to the order quantity Q, yields the slope of the total cost curve, and equating to O to minimize ‘T’.

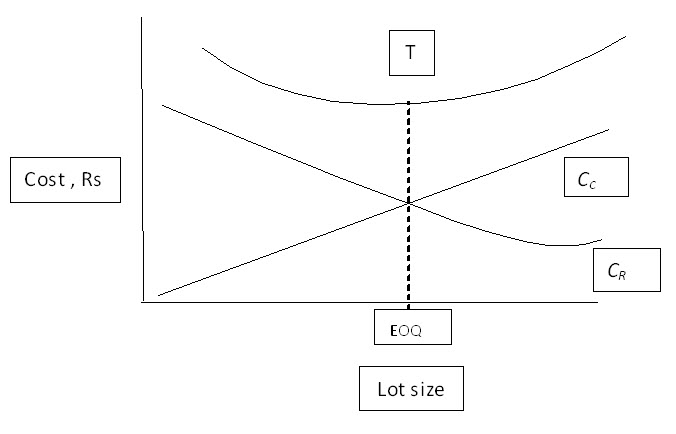

Eq.(3) is known as the Economic Order Quantity (EOQ) or Economic Lot Size (ELS) equation. Fig. describes the relationship between the relevant ordering and carrying costs. Note also that the total cost curve is relatively flat in the area of the EOQ, so small changes in the amount ordered do not have a significant effect on total costs.

Once the economic order quantity Q is determined, the minimum inventory cost can be computed by substituting this Q value into the total cost equation.

The number of orders per year,

If the manufacturer or supplier offers any discount for a minimum purchase order, the total cost will be calculated and the unit cost will be compared in both cases.

Total cost as per EOQ,

and calculated unit cost,

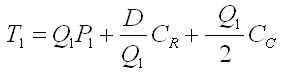

In some cases the manufacturer / supplier will extend a discount on the unit cost when a prescribed minimum quantity is purchased or ordered. If Q1 is the minimum of units to be ordered and P1 is the unit cost with discount, total cost as per minimum order,

Calculated unit cost,

The purchase is effected based on the lower unit cost.

The assumptions of this model are:

-

Demand is known and constant

-

Lead time is known and replenishment is instantaneous at the expiration of the lead time.

-

Ordering and carrying costs include all the relevant costs and are constant.

-

Purchase cost do not vary with quantity ordered.

Fig.1.Relationship between the costs and the lot size.

7. Inventory Control Systems

Several other types of control systems have been in use for some time to achieve the various purposes of inventory. ABC method of determining which inventory items deserve most attention, and then at three traditional inventory control systems: (1) fixed-order quantity or fixed quantity – Q system, (2) fixed-order interval (fixed period) – P system, and (3) base stock (as and when exhausted to be ordered). These systems, by themselves, are essentially only. “Order launching” techniques for they basically only get an order issued but offer little in the way of follow-up control. They also tend to look back at historical average usage rather than ahead to a forecast of material requirements.

7.1. ABC analysis

The time and recordkeeping activities required to control inventories cost organization money. Some items do not warrant as close and exacting control as others, for a small percentage of items usually accounts for a large percentage of an inventory investment. This widely recognized fact has led many firms to classify inventories into three groups designated A, B, and C:

-

items include the 10-20 percent of items that typically account for 70-80 percent of the total value of inventory.

-

items include about 30-40 percent of items that account for about 15-20 percent of the total value of inventory.

-

items include about 40-50 percent of items that account for about 5-10 percent of the total value of inventory.

This classification system reveals that for most inventories the bulk of items typically account for only 5-10 percent of value and suggests that the firm have plenty of these low-value items on hand but concentrate the more costly control efforts on the high-value items. Class A and B items are sufficiently valuable or vital to warrant a close control under some type of perpetual or periodic monitoring system. Class C items are sometimes managed on a two-bin system basis.

7.2. Fixed-order quantity system

The fixed-order quantity inventory control system is a perpetual system which keeps a current record of the amount of inventory in stock. A fixed quantity Q is ordered when the order point is reached (that is, when the amount on hand, without using the safety stock, will just meet the average demand during the lead time). This type of system, illustrated in figure, lends itself to the use of EOQ purchasing methods. The system requires continuous monitoring of inventory levels, which can easily be done if the system is computerized. Because of this, it is often used for inventories that have large, unexpected fluctuations in demand.

7.3. Fixed-order interval system

In the fixed-order interval system the amount of inventory in stock is reviewed at periodic intervals, such as weekly or monthly. A variable quantity Q is then ordered on a regular basis. The order quantity is adjusted to bring the inventory on hand and on order up to a specified level. Since the safety stock must provide protection over the entire cycle it is typically larger than would be required under a fixed-order quantity system, where the safety stock must protect over the lead time only. This system does not, however, require continuous monitoring, and is especially useful for processes that call for a consistent use of material. It also lends itself to conditions where a single review period can identify several items which can then be ordered at one time, with a possible savings in the ordering cost.

7.4. Base stock system

The base stock system is one of many combinations of inventory systems and has elements of both the fixed-order interval systems. In this system, inventory levels are reviewed periodically, but orders are placed only when the stock is below some specified level. The system thus provides some of the control aspects of periodic review systems but would typically result in the placement of fewer orders, and orders of a more economic lot size.

Example 1: A tractor manufacturer purchases the rear wheel tyres from a leading tyre manufacturer. The annual requirement of tyres is 3000 numbers which spreads over uniformly. The cost of each tyre is Rs.9,800. The ordering cost is Rs.2500 per order and the carrying cost is 2% of the cost of the year during the stock period. Determine the economic order quantity and the unit cost of the tyre on site.

Given,

Annual demand, D = 3000

Unit cost, P = Rs.9800

Ordering cost, CR = Rs.2500 per order

Carrying cost, CC = 2% of P

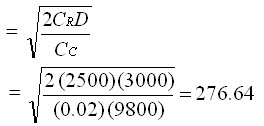

Economic order quantity, Q

= 277 no. of tyres

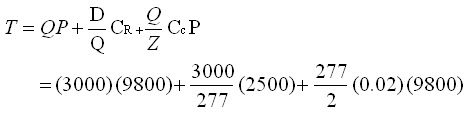

Total cost for 3000 tyres,

= Rs. 2,94,54,221/-

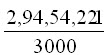

Unit cost of tyre on site = = Rs.9818/-

= Rs.9818/-

Example 2: A food processing industry buys tin cans for packaging their food product. The processing capacity of the industry is 5 tonnes per day and produces 10,00,000 cans annually. The cans are bought from a leading manufacturer. The expenditure involved in placing the order is Rs.5,000/- per order and the carrying cost is 2% of the unit cost. The industry propose to purchase the cans based on the economic order quantity. However the can supplier offers a discount of 2% on the unit cost of Rs.8/-. Advise the food processing industry whether to avail the discount, if the carrying cost and ordering cost remains same.

Given:

Annual demand for cans, D = 10,00,000

Unit cost of cans, P = Rs.8/-

Ordering cost, CR = Rs.5000/- per order

Carrying cost, Cc = 2% of the cost of the can

Discount offered = 2%

Case I (without discount)

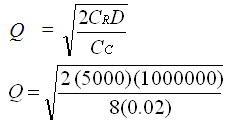

Economic Order Quantity,

= 79096; say 80,000

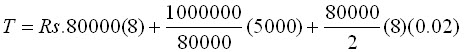

Total cost of cans,

= Rs.7,08,900/-

Unit cost on site, ![]() = Rs.8.86/-

= Rs.8.86/-

Case II (without discount)

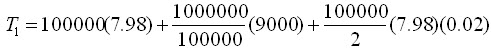

Discounted price, ![]() = Rs.7.98

= Rs.7.98

Minimum order quantity, Q1 = 1,00,000 numbers

Total cost of cans,

= Rs.8,55,980/-

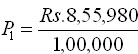

Unit cost on site,  = Rs.8.56

= Rs.8.56

Based on the unit cost of the cans, with and without discount, the industry may be advised to avail the discount which saves Rs.0.36 per can.